Bookkeeping for Inventory Transactions

Now, let’s say you bought $500 in raw materials on credit to create your product. Debit your Raw Materials Inventory account to show an increase in inventory. Debits increase your expense accounts because they represent money going out. For instance, when you pay your employees, you debit the expense account to show the outflow of cash for wages.

3.2 Merchandising Transactions (perpetual inventory system) with Discounts – The Seller

A journal is a record of each accounting transaction listed in chronological order. As a general overview, debits are accounting entries that increase asset or expense accounts and decrease liability accounts. When goods are sold, properly record the transactions and ensure that the correct items are billed and shipped to customers. Record sales in the sales operating account with the appropriate sales object code. Transfer the inventory cost of goods sold to the operating account using a cost of goods sold transaction.

Journal entry accounting

Each journal entry consists of at least one debit and one credit, with the total debits equaling the total credits. Journal entries are used to update the general ledger accounts and form the foundation for financial statements. inventory debit or credit The most important thing to remember is that when you’re recording journal entries, your total debits must equal your total credits. As long as you ensure your debits and credits are equal, your books will be in balance.

Post navigation

- Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

- By mastering the concepts outlined in this guide, businesses can effectively record transactions, analyze financial performance, and make informed decisions.

- It is positioned to the left in an accounting entry, and is offset by one or more credits.

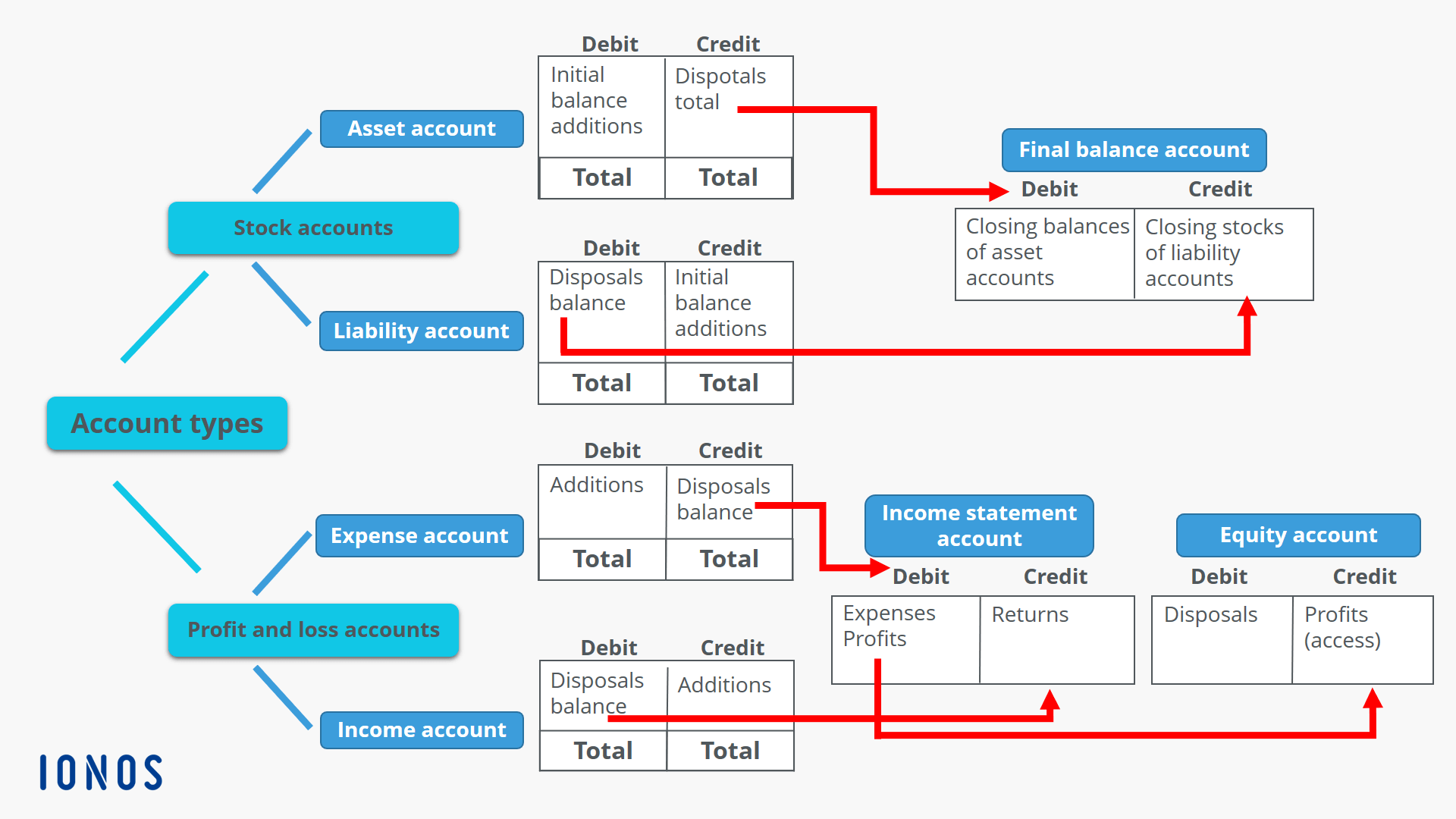

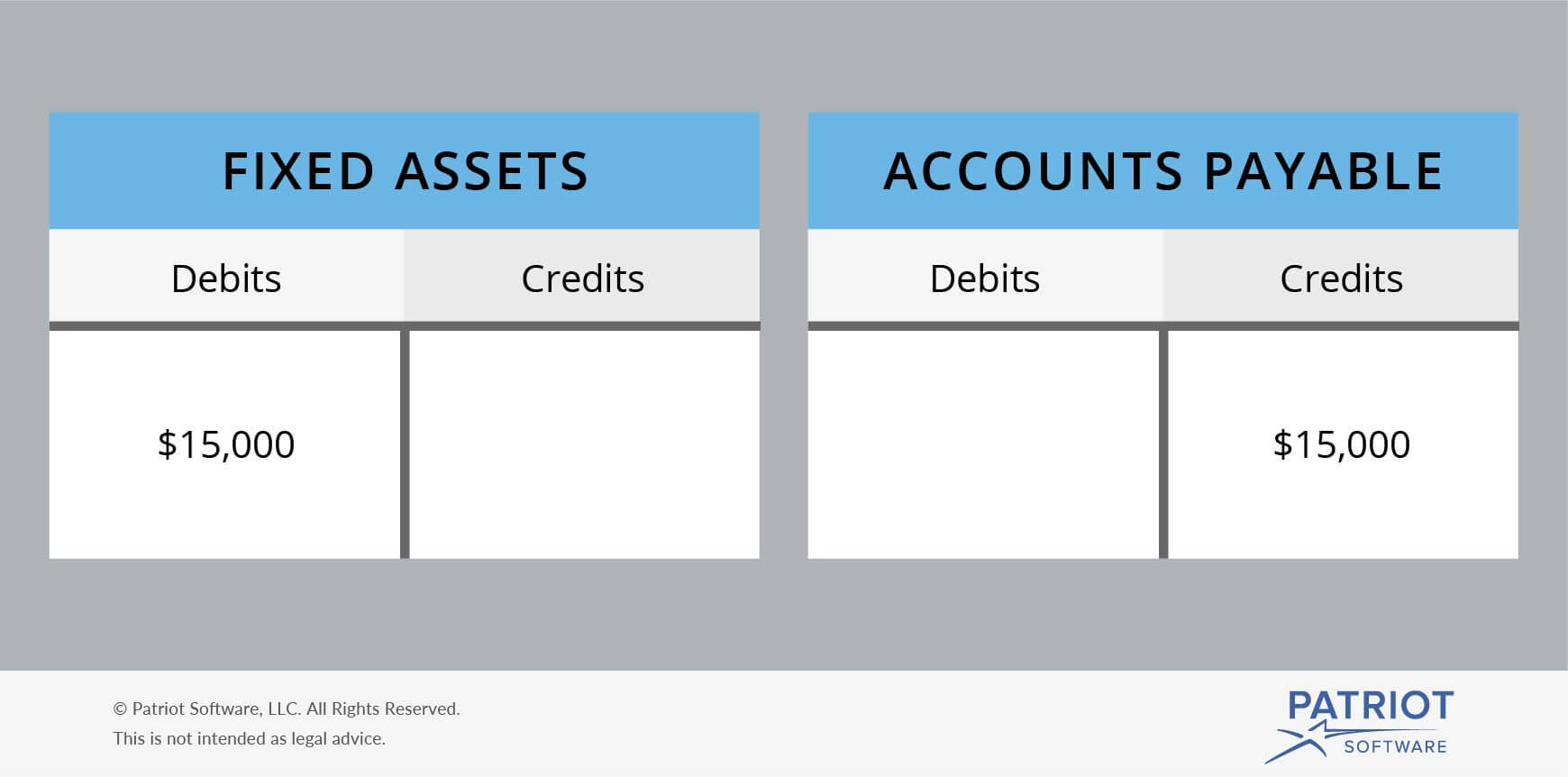

The left side of the T represents the debit side, and the right side represents the credit side. Fortunately, if you use the best accounting software to create invoices and track expenses, the software eliminates a lot of guesswork. T accounts are simply graphic representations of a ledger account. To understand how debits and credits work, you first need to understand accounts.

Automate Your Debit and Credit Accounting with Vencru

That means keeping accurate and up-to-date financial records for business management purposes and tax return filing. By following International Financial Reporting Standards (IFRS), a business can determine the appropriate information as required, like corresponding inventory accounting numbers. Double-entry accounting is the process of recording transactions twice when they occur. A debit entry is made to one account, and a credit entry is made to another.

For example, you generated $10,000 in revenue and incurred $7,000 in expenses. Additional entries may be needed besides the ones noted here, depending upon the nature of a company’s production system and the goods being produced and sold. After you receive the raw materials, you will eventually use them to create your product. To ensure that everyone is on the same page, try writing down your accounting routine in a procedures manual and use it to train your staff or as a self-reference. Even if you decide to outsource bookkeeping, it’s important to discuss which practices work best for your business.

Debits and credits are recorded in your business’s general ledger. A general ledger includes a complete record of all financial transactions for a period of time. An interesting point about inventory journal entries is that they are rarely intended to be reversing entries (that is, which automatically reverse themselves in the next accounting period). Then, when you locate obsolete inventory and designate it as such, you credit the relevant inventory account and debit the obsolescence reserve account. This approach charges the cost of obsolescence to expense in small increments over a long period of time, rather than in large amounts only when obsolete inventory is discovered.

A single entry system is only designed to produce an income statement. A single entry system must be converted into a double entry system in order to produce a balance sheet. The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software.

In this guide, we’ll provide an in-depth explanation of debits and credits and teach you how to use both to keep your books balanced. This can be seen most prominently in products that require exceptional time or expense in secondary stages of production. Items such as pharmaceuticals, machinery, and technology are three products that require large amounts of expense after their initial designing. The other item the GAAP rules guard against is the potential for a company to overstate its value by overstating the value of inventory. Since inventory is an asset, it affects the overall value of the company. A company which is manufacturing or selling an outdated item might see a decrease in the value of its inventory.

The perpetual inventory method is a method of accounting for inventory that records the movement of inventory on a continuous (as opposed to periodic) basis. It has become more popular with the increasing use of computers and perpetual inventory management software. Your accounting system will work, whether its for debit or credit accounting, if everyone applies the debit and credit rules correctly.