With the help of our $500 Financing – Borrow funds loan app, you will be ready to accept a wet go out otherwise unforeseen demands

Whatever overall economy you are today up against, there’s absolutely no need to place it off up to it will become a large deficit. Borrow cash right now using this application and employ it to fulfill your existing requirements.

Do you require a few hundred dollars to settle early in the day-owed debts? Is there a beneficial $500 automobile repair prices that really must be reduced? Instant cash funds are designed to add the consumer having quick and simple use of a lot more bucks.

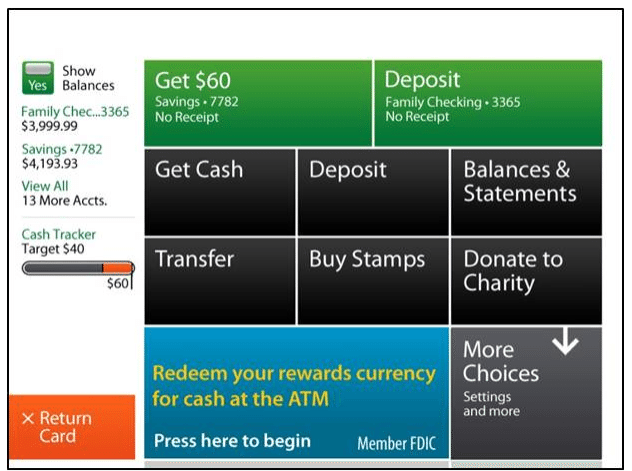

With our quick Borrow funds application, you could effortlessly create and you will manage your expenses. It is simple and safe to own more cash on your own pocket from the comfort of your own smart phone.

You will never know in the event that next disaster tend to hit. You can now get fast dollars money from home. That is all you need to deal with a short-name economic snag.

That it Borrow money app was designed to permit all of the user found cash today by giving entry to a fast financing off people location. Overlook the inconvenience and you will time-ingesting files. Cannot drop time if you want a little extra cash until next pay-day. A quick cash software can be very useful. With our very own software, you should buy cash today!

Such small personal loans was unsecured and sometimes made available to consumers which have a or excellent fico scores

– Easy and fast availability 24 hours a day, 7 days per week – Brief approach to rating bucks instantaneously – Delicate credit query – Instantaneous financing no paperwork or faxing documents- Small currency of these which have poor credit