To own loan numbers more than $3MM (or $2MM for resource attributes), consumers need to meet post-closure asset standards in order to be considered

When debating between leasing against. to purchase, you need to consider carefully your life and you may funds. While you are leasing also have significantly more flexibility, owning a home makes you make guarantee from the assets and will give tax masters.

The new apr (APR) is the price of borrowing from the bank along side name of your own loan expressed while the a yearly rates. The latest Apr revealed the following is in line with the interest, any dismiss issues, and you will mortgage insurance policies to have FHA funds. It generally does not think about the operating payment or people almost every other loan-particular finance costs you may be needed to pay. Pricing was estimated by county and genuine pricing may differ.

FHA funds wanted an up-front side financial cost (UFMIP), which is often funded, or paid at the closure, and you will an enthusiastic FHA annual financial cost (MIP) paid back monthly will even pertain

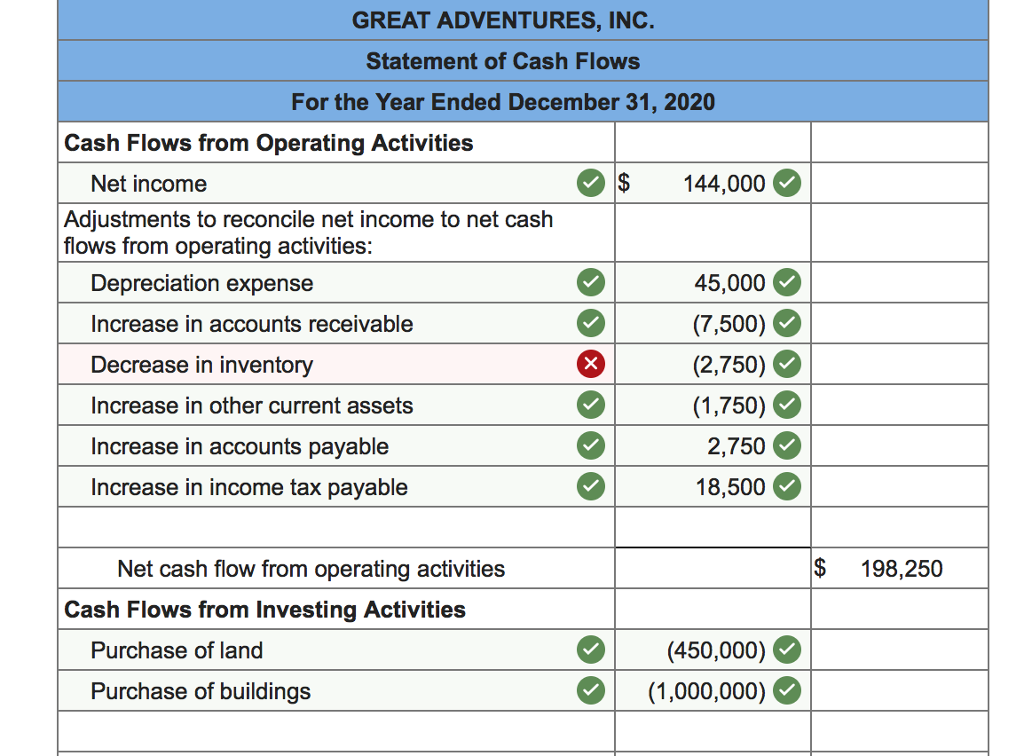

Purchase: Prices demonstrated regarding the table tend to be as much as step one part consequently they are according to the adopting the assumptions: conforming 30-seasons repaired, 15-seasons repaired, 7/6 Sleeve and you will 5/6 Sleeve considering a loan amount of $350,000 with an advance payment off 20%. 30-year fixed FHA considering an amount borrowed out of $250,000 with a deposit of 5%. 30-season fixed jumbo and 10/6 Desire Merely Sleeve jumbo items are considering a loan level of $1,3 hundred,000 which have a deposit out-of 30%. Every financing imagine just one-household members residence; buy financing; home loan price lock period of thirty day period and you will customers character which have expert credit. Read more