If you’re considering taking out a house guarantee loan, it is very important see the tax ramifications

- Certification to the deduction: So you’re able to be eligible for our home equity financing appeal deduction, you ought to satisfy the needs. This type of criteria become by using the mortgage to acquire otherwise change your household, and you may meeting the amount of money and you may ownership requirements.

If you’re not planning to make use of the financing to acquire or improve your family, you can also imagine another kind of loan, particularly a consumer loan otherwise credit cards.

Is going to be difficult to be eligible for

Household equity fund should be a great way to availableness the fresh new guarantee you really have built up of your house, nonetheless they is hard to be eligible for, especially if you features a minimal credit rating otherwise a high debt-to-earnings proportion.

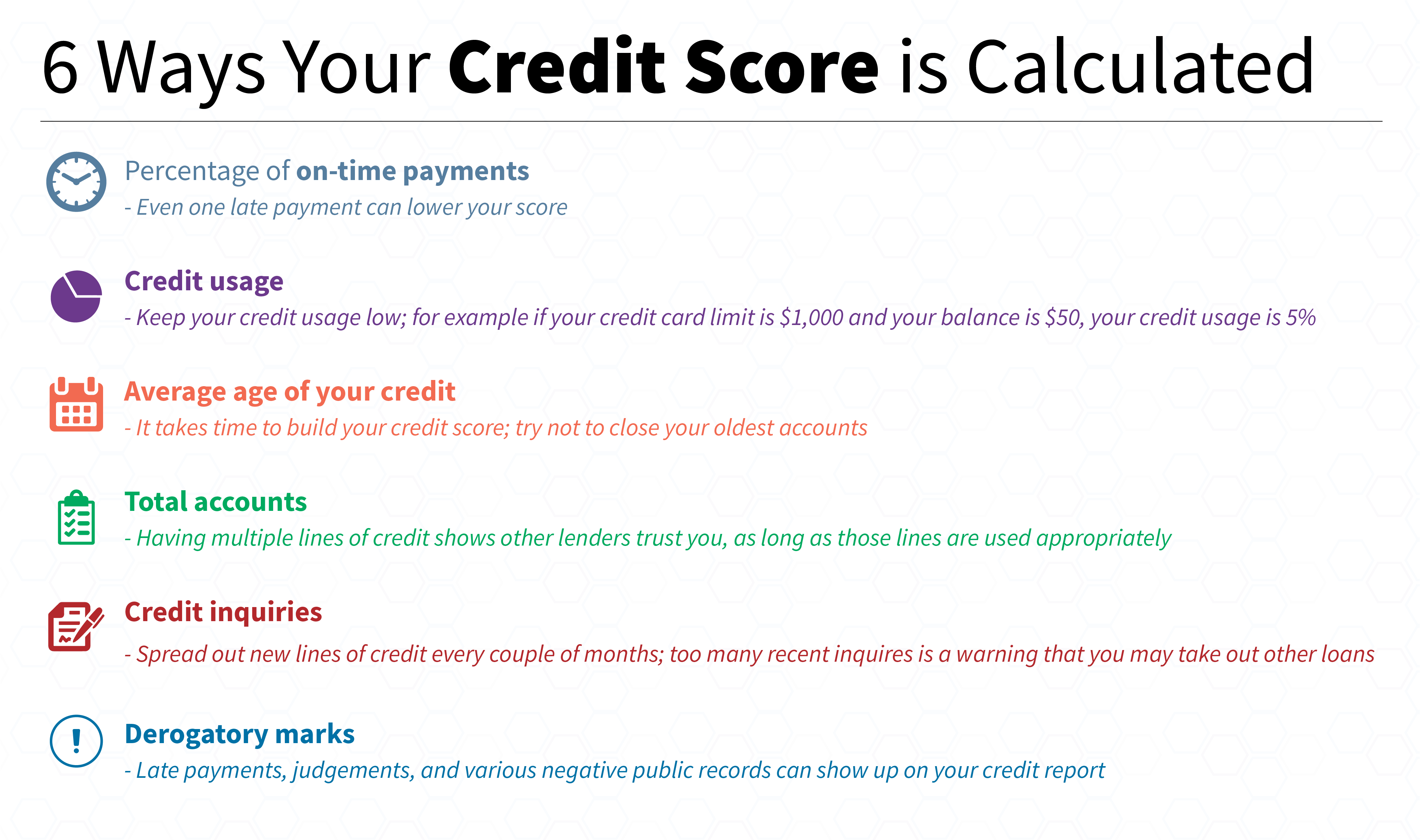

Loan providers generally check your credit rating and you will loans-to-earnings ratio whenever comparing the job to have a house guarantee mortgage. A minimal credit history often means in order to lenders that you’re a risky debtor, and a high obligations-to-income ratio causes it to be burdensome for one to pay the latest loan. Consequently, you may be declined for a home equity mortgage, or you may only end up being recognized for a loan that have good large interest. Read more