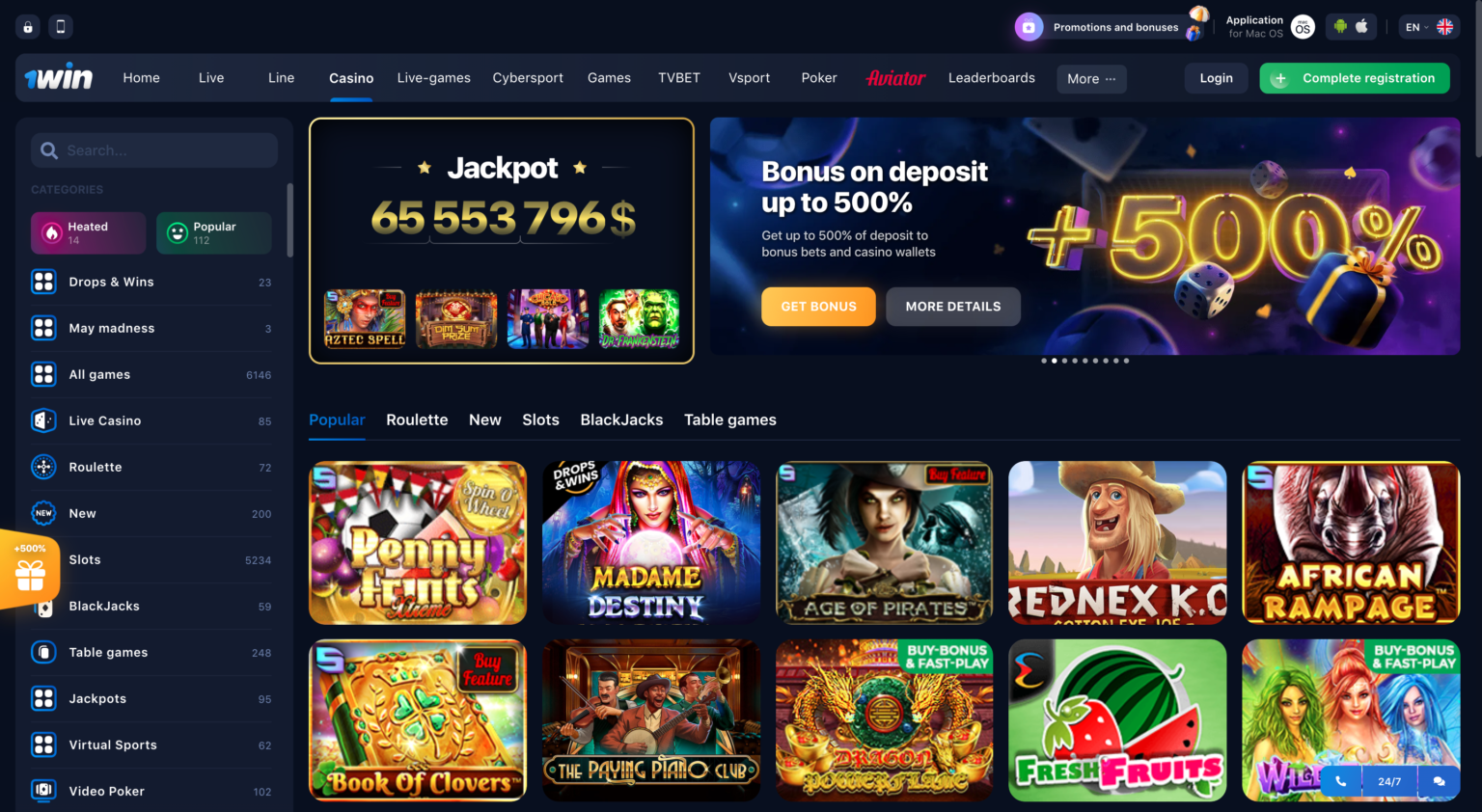

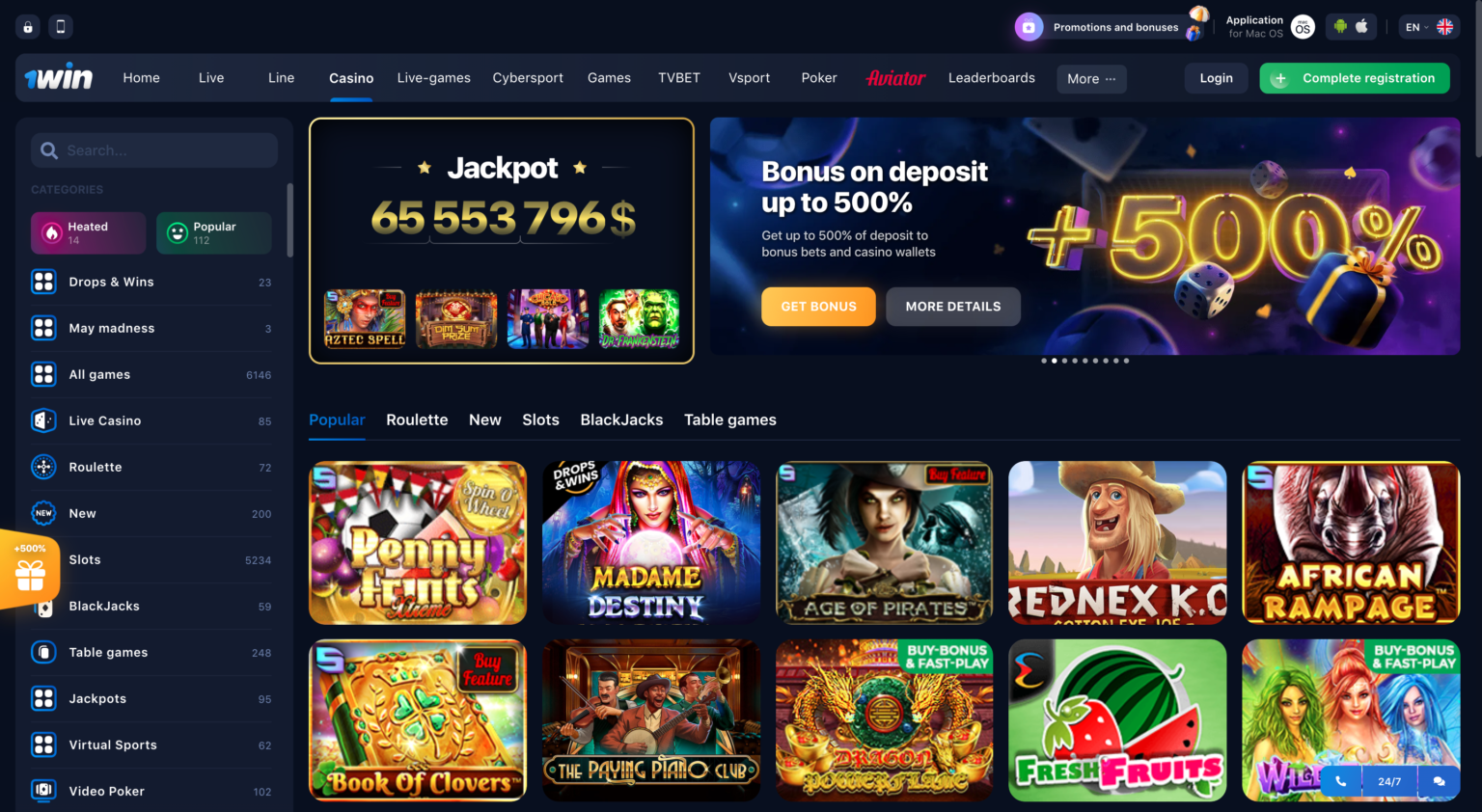

La plataforma de casino 1win pone al alcance de su comunidad, una amplia gama de juegos de gran renombre y desarrollados por los mejores proveedores. Juegos de mesa, tragaperras y de lotería que garantizan seguridad y excelentes dividendos. 1Win Aviatrix es un juego de choque diseñado para los amantes de los aviones, pero está súper mejorado. La plataforma de 1win se destaca por su variedad entre las categorías de deportes ofertados en todas las modalidades.

¿Cómo registrarse en 1Win Casino Chile?

Cuanto más suba el avión, mayores serán las ganancias; sin embargo, si el avión cae y no recoges la apuesta, perderás. Los deportes virtuales son la simulación de deportes reales con la ayuda de juegos de computadora y consolas de juegos. Las apuestas están disponibles en estos juegos, pueden ser FIFA, NHL, NBA y otros juegos.

¿Es seguro 1win Casino?

Allí te sientas como lo harías en un casino de verdad, pero en lugar de ponerte un traje, estás en el sofá en pijama. Hay un crupier de verdad, ruleta o bacará de verdad, y estás como en un casino de verdad, sólo que sin todo el ajetreo. Y, por cierto, es genial para los principiantes, porque sientes el ambiente, pero no te preocupa cometer un error o hacer el ridículo.

Nuevos juegos

Muchos se preguntan 1win que tan confiable es, y es porque quieren hacer depósitos en criptomonedas con este método de pago. Si eres de los que disfrutan los clásicos, el casino de 1win también es para ti. Es importante mencionar que en todas estas opciones podrás disfrutar de la experiencia en vivo, por lo que tendrás un incentivo de alegría adicional. Si quieres ganar en grande, 1 win es una buena opción para ti, dado que cuenta con un excelente rendimiento y crecimiento en el mercado chileno.

Opciones de Apuestas y Juegos en 1 win

Con su llegada a Chile ha logrado reunir a cientos de apostadores, ofreciéndole los juegos de los mejores desarrolladores de casino como Pragmatic, Novomatic, Playson, entre otros. Además, se ha sabido adaptar a los requerimientos actuales con excelentes promociones y apuestas en vivo. Este juego de crash es popular en 1win, trata sobre dos carros que tratan de huir de la policía a máxima velocidad.

- Además, cuenta con otras ofertas como cashback en el casino, rakeback en póker, giros gratis y muchas otras que te harán ganar en grande.

- Dispone para sus usuarios, de todos los eventos en vivo de los deportes más buscados con infinitas oportunidades de jugadas.

- Los términos de los bonos pueden cambiar con el tiempo, por lo que es importante seguir las actualizaciones en la sección de bonos y promociones en casa de apuestas 1win.

- Para los jugadores que buscan una experiencia de juego más interactiva y competitiva, 1Win Casino ofrece juegos y torneos de casino en vivo.

- Al introducir estos códigos durante el proceso de registro o de apuesta, los jugadores pueden desbloquear esta bonificación.

- Si bien es posible que PayPal no esté disponible como opción de pago en 1Win Casino, el casino admite varios otros métodos de pago convenientes y seguros.

- Esta casa de apuestas cuenta con uno de los mejores bonos de bienvenida del mercado, llegando a ser de hasta 500%.

- El voleibol es mundialmente reconocido por sus reglas de juego y partidos constantes.

Paso 4: Disfruta de tu Bono

Durante la ronda, el jugador tiene una influencia en el porcentaje tanto del perdedor como el ganador. 1Win es parte de las casas de apuestas de mayor confianza y popularidad cuando de las apuestas en vivo se trata. Cuenta con todos los eventos en vivo sobre los deportes más populares y con infinitas jugadas. Mientras que la versión móvil se puede utilizar en cualquier navegador, la aplicación aporta rapidez y calidad en las jugadas. En cuanto a las promociones y bonos, es posible optar por ellos en ambas modalidades.

Juegos Cash o Crash

Los usuarios en 1win casino online pueden jugar en más de 10,000 títulos de diferentes categorías y temáticas en 1win. Destacamos clásicos de tragamonedas, juegos que no pueden faltar de póker y hasta juegos modernos de crash. Para aquellos que buscan la emoción del juego en tiempo real, la sección de juegos en vivo del casino online 1win ofrece muchas mesas en vivo con crupieres profesionales, que proporcionan una experiencia de juego inmersiva y auténtica. 1win Casino online Chile es uno de los sitios de juego en línea más populares, que ofrece a sus usuarios una amplia gama de entretenimiento.

🎁 ¿Cuáles bonificaciones y ofertas facilita 1win a sus usuarios?

Si eres amante del baccarat, en este casino podrás apostar al jugador o a la banca. En cada uno de estos encuentros, podrás disfrutar de la manera más activa, porque 1win tiene una plataforma de streaming en Full HD con resolución 4K en la que podrás disfrutar de tus eventos favoritos. Dentro de los deportes en los que cuentan con mayor variedad de apuestas reinan el fútbol y el baloncesto. Pero, eso no es todo, porque si tienes gustos más específicos también podrás apostar en hockey sobre hielo, carrera de galgos, boxeo, bádminton, voleibol, rugby, tenis, pádel, béisbol, Fórmula 1, artes marciales y otros. En esta plataforma vas a poder encontrar una gran cantidad de categorías deportivas para hacer tus apuestas y no solo eso, sino que tendrás cientos de mercados de apuesta con las mejores cuotas de todo Chile. Efectivamente, todo este crecimiento se ha debido a que esta casa de apuestas ha sabido apoderarse del mercado y esto le ha permitido extenderse a nuevas naciones.

Aplicación 1Win en Chile

Cada método de pago en 1win Chile tiene un depósito mínimo, así como un máximo. Para pagar podrás usar estos métodos de pago que varían en el tiempo de procesamiento y en sus montos mínimos y máximos. Pero eso no es todo, también podrás disfrutar del blackjack, saca las mejores cartas para alcanzar el 21 ideal de entre las 52 cartas que conforman la baraja y gánale a la casa.

¿Cómo funcionan las bonificaciones y promociones en los casinos en línea?

Los bonus codes 1win funcionan como una clave para acceder a promociones exclusivas. Al ingresar un código al momento de registrarte o realizar un depósito, desbloqueas beneficios adicionales como giros gratis en juegos de casino, bonos de depósito, o bonos sin necesidad de depósito. Estos códigos están diseñados para aumentar tus posibilidades de ganar y mejorar la experiencia de juego en la plataforma.

Consejos para Usar los Giros Gratis

Además de los juegos de azar disponibles en 1win, los usuarios también pueden poner su suerte en la categoría de “Deportes”. Disfruta de los mejores eventos con altas cuotas y variedad en las líneas de pagos, fútbol, tenis, baloncesto y hasta los juegos de eSports están disponibles en 1win. Una de las características de juegos más interesantes en 1win casino es que ofrecen títulos totalmente en exclusivos de la plataforma, en estos juegos podrás probar tu suerte y disfrutar de las apuestas como nunca antes. La app de casino 1win, disponible tanto para Android como para iOS, ofrece un fácil acceso a los juegos en inglés y español.

La primera acción que debes tomar es asegurarte de que el bonus code 1win esté escrito correctamente. Revisa si has ingresado el código con precisión, sin errores tipográficos ni espacios adicionales. Un error común es introducir un código incorrecto o desactualizado, lo que puede impedir que se active el bono. Disfruta de tus Giros Gratis¡Ya estás listo para disfrutar de tus giros gratis! Utiliza los giros para jugar en las tragamonedas seleccionadas y trata de ganar sin arriesgar tu propio saldo.

Únete a 1WIN Chile y diviértete con los juegos de casino

Casino 1win es confiable gracias a sus procesos de seguridad y protocolo de registro, en este caso te dejamos el paso a paso de manera detallada. Sí, 1Win Casino acepta criptomonedas como métodos de depósito, incluido Bitcoin. Los jugadores pueden disfrutar de los beneficios de transacciones seguras y anónimas utilizando criptomonedas. Si después de seguir estos pasos el bonus code 1win aún no funciona, lo mejor es contactar con el servicio de atención al cliente de 1win. Ellos podrán asistirte con cualquier problema relacionado con la activación de tu código.

El cliente deberá enviar sus documentos para la verificación y confirmación de los datos de pago que se utilizaron anteriormente. Si tienes un iPhone el proceso es diferente porque lo ideal es que descargues la app, desde la App Store, con la que tendrás una experiencia optimizada del casino. La misma se adapta de manera ideal a la pantalla y software de estos dispositivos para que puedas jugar desde donde estés.

Por otra parte, destacamos que los usuarios en 1win casino pueden usar la aplicación móvil del casino para jugar con mayor comodidad, esta app está disponible en la misma página principal. Además, podrás jugar con el bono de bienvenida del 500% en los primeros depósitos, los juegos de casino en vivo y más funciones que hacen de esta web única en el mercado iGaming en Chile. La principal misión de 1win casino Chile es la de ofrecer un gran servicio a los usuarios que sea seguro, transparente y con grandes beneficios usando los bonos de 1win.

¿Es legal y seguro en Chile?

Las tragamonedas que generan más interés se pueden filtrar por proveedor y título, y se pueden crear categorías separadas con nuevos lanzamientos particularmente emocionantes y los títulos más populares. Además, el sitio cuenta con una sección de tragamonedas jackpot, que cuenta con más de 45 tragamonedas. Asimismo, cuenta con la tecnología TLS, por lo que 1win es seguro para todos sus clientes y la hacen una de las casas más buscadas por su robusto sistema de protección de datos. Cada vez es más frecuente que los apostadores utilicen este método de pago, dado que pueden disfrutar de inmediatez, seguridad y privacidad en sus transacciones. Como pudiste apreciar en las secciones anteriores, sus límites de depósito y retiro también son muy convenientes si lo que te gusta es apostar en grande.

Si eres un jugador en Chile, te estarás preguntando cómo aprovechar estos códigos para maximizar tu experiencia en 1 win Chile. En este artículo, exploraremos cómo puedes utilizar los bonus code 1win para obtener acceso a estas promociones, qué tipo de bonos están disponibles, y cómo sacarles el máximo provecho. Además, te explicaremos cómo usar el bonus code 1win para obtener bonos de casino 1 win y más. En términos simples, los fondos recibidos como obsequio del operador se utilizan solo en apuestas deportivas.

Además, 1win Cassino gratis ofrece una función de chat en vivo accesible en el sitio web para obtener asistencia inmediata. Se trata de una opción que proporciona el casino 1Win y que consiste en una sección que hallarás en la barra superior de la plataforma. Al dar clic en ella, serás redirigido a una interfaz muy intuitiva y completa para realizar trading con opciones binarias.

Si estás en Chile y quieres jugar a juegos de casino desde la comodidad de tu casa (o incluso de tu habitación), para que sirve el bonus casino en 1win es el lugar al que debes ir. Yo mismo he jugado allí un par de veces y, para ser sincero, no me ha decepcionado. También hay todo tipo de bonificaciones que se pueden activar directamente a través de la aplicación. Por ejemplo, cuando me registré por primera vez, utilicé el código promocional 1WINBIG500, e inmediatamente obtuve una bonificación en mi primer depósito. Básicamente, no sólo juegas, sino que también tienes oportunidades extra de ganar. Escucha, si estás en Chile y quieres apostar en deportes o jugar juegos de casino directamente desde tu teléfono, entonces 1Win App es lo que necesitas.

- Esta particularidad hace de estos juegos una fuente de cuantiosas ganancias o pérdidas, depende del caso.

- Antes de entrar en una plataforma para jugar con dinero real, destacamos que debes estar al tanto de la seguridad de la web para evitar cualquier tipo de problema.

- Opera bajo una licencia de juego de Curazao, lo que garantiza el cumplimiento de los requisitos legales y los estándares de la industria.

- Aunque la plataforma no está regulada específicamente por las autoridades chilenas, 1win opera de manera legal en el país, ofreciendo a los usuarios la posibilidad de disfrutar de sus juegos y apuestas de manera responsable.

- El cliente deberá enviar sus documentos para la verificación y confirmación de los datos de pago que se utilizaron anteriormente.

- El mismo juego te ofrece una opción de “Retiro automático” con la que podrás retirar las ganancias al alcanzarse la cuota deseada.

- Además de esto, al recargar su saldo, los jugadores pueden utilizar un código promocional al recargar, lo que les permite obtener fondos adicionales para jugar.

Su esquema facilita el buen manejo de herramientas con instrucciones detalladas. El bono de 1win es confiable desde el primer momento y se aplica a los primeros 4 depósitos, dando una suma del 500% de monto depositado. La promoción solo es canjeable por los usuarios recién registrados o que no hayan optado por sus primeros ingresos de depósito. Debido a las numerosas ventajas de la plataforma de apuestas sobre sus competidores, 1Win tiene una calificación y valoración muy altas entre los usuarios. Es gu juego que combina lo mejor de los partidos con las apuestas para obtener grandes premios.

El equipo de desarrollo mantiene actualizada la web con todas las tendencias de juegos y apuestas para la experiencia óptima de todo usuario. Los apostadores chilenos pueden elegir entre las opciones del catálogo y dar uso de las promociones que se encuentren vigentes. Con buenos métodos de pago, los jugadores de Chile y de todo el mundo pueden realizar depósitos y retiros rápidos de las cantidades de dinero que necesiten.

Los apostadores pueden elegir entre los campeonatos con clasificación masculina o femenina según la temporada. Las 1win apuestas en vivo generan más emoción que otra modalidad en esta disciplina. Los jugadores pueden apostar por la cantidad de sets por combate o por la cantidad de puntos que obtendrá cada competidor. Para el recibimiento legal de cada bono, se consideran los términos asignados ante la obtención y uso. La aplicación de promociones adicionales genera mayores victorias en dinero real. El código promocional 1win es una oferta exclusiva para la comunidad, el cual brinda una recompensa al ser canjeado.

1Win Casino ofrece una amplia selección de juegos de casino, mercados de apuestas deportivas y opciones de casino en vivo, lo que garantiza que los jugadores tengan muchas opciones para satisfacer sus preferencias. Uno de los aspectos más atractivos de 1Win es su completo programa de bonos, diseñado para ofrecer a los jugadores mayores oportunidades de ganar y extender su tiempo de juego. A través de diversas promociones, la plataforma permite que tanto los nuevos usuarios como los jugadores frecuentes puedan beneficiarse de incentivos exclusivos. Desde bonificaciones en depósitos hasta promociones especiales para apuestas deportivas y casino, 1Win se posiciona como una opción ideal para quienes buscan maximizar su experiencia en el mundo de las apuestas en línea. Los bonos y promociones de 1Win representan una oportunidad única para los jugadores que buscan maximizar su saldo y mejorar su experiencia de juego. Gracias a una amplia variedad de bonificaciones, desde atractivos incentivos en los depósitos hasta promociones exclusivas para apuestas deportivas y juegos de casino, la plataforma ofrece múltiples formas de obtener beneficios adicionales.

Los términos de los bonos pueden cambiar con el tiempo, por lo que es importante seguir las actualizaciones en la sección de bonos y promociones en casa de apuestas 1win. Dentro del entretenimiento que se brinda en la casa de apuestas, está el TV Juegos; estos son un repertorio de juegos que van desde los más populares hasta los clásicos y actuales. Debido a esto, cada vez es mayor la cantidad de usuarios que se sienten atraídos por los beneficios de estos juegos. Debido a la licencia internacional que posee, los jugadores chilenos pueden disfrutar de una gama extensa de eventos deportivos, salas de juegos de mesa, tragamonedas, y más. Si no quiere estar jugando todo el tiempo con el PC, cuenta con una aplicación móvil. Para realizar un registro a través de redes sociales, los jugadores solo deben ubicar en el proceso de registro la opción de registrar mediante.

Los jugadores pueden ponerse en contacto con el soporte en cualquier momento y obtener la ayuda que necesitan. El baloncesto también es famoso por sus frecuentes torneos como el Eurobasket, el Campeonato Mundial, el Campeonato Asiático, etc. Puede apostar a resultados como ganar el partido, número total de puntos, número de tiros libres, número de tiros de tres puntos, etc. Después del registro, será redirigido a su gabinete personal, tendrá el suyo propio acceso al área personal.

El tenis es famoso por sus coloridos torneos como los torneos de Grand Slam, la Copa Davis, el torneo final del año, etc. Los mejores resultados disponibles son la victoria de un determinado jugador en un partido, la diferencia de goles, el empate, etc. La aplicación es muy conveniente y funciona perfectamente, puedes usarla en cualquier parte del mundo, solo necesitas una conexión a Internet estable. Sin embargo, es importante tomar fotografías de buena calidad de sus documentos para que pueda verlo todo. Este es un juego muy popular con funciones rápidas y perfecto para jugarlo entre eventos.

Yo mismo la descargué hace un par de meses y ahora no me imagino cómo jugaba sin ella. Además, en 1Win de Chile puedes hacer depósitos y retirar dinero de forma segura a través de métodos locales, por lo que no tendrás problemas para ingresar fondos en tu cuenta. Yo, por ejemplo, utilicé tarjetas, pero hay otras opciones – lo que es conveniente, usted puede elegir por sí mismo.