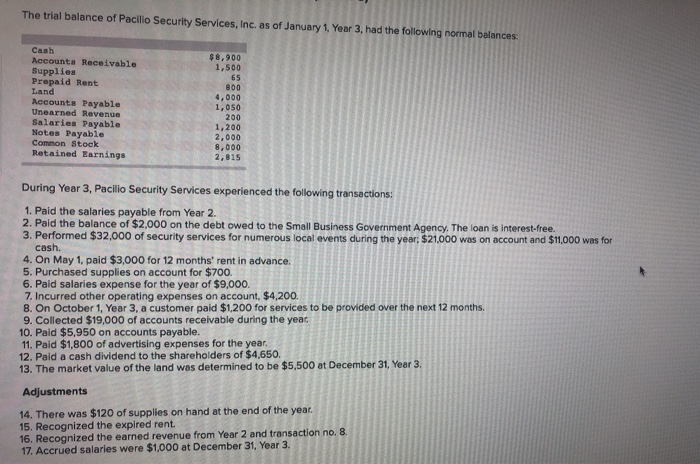

In terms of a house collateral personal line of credit (HELOC), you to definitely concern very often comes up is if an assessment is required. The solution to that it concern utilizes several affairs, including the lender’s criteria, the degree of collateral you have got on your own possessions, and the sum of money we would like to borrow.

Overall, lenders require an appraisal to select the value of your home plus the quantity of guarantee you’ve got before granting an effective HELOC. Simply because how much cash you could use are according to the equity you have got of your house. Yet not, certain lenders can offer zero-assessment HELOCs or waive new assessment significance of borrowers whom fulfill specific conditions.

It’s important to keep in mind that even though an appraisal are not essential, it may remain best if you have one so you’re able to remember to commonly credit more your house is value. Concurrently, an appraisal can give you a much better comprehension of the property’s really worth that assist you create advised choices regarding the finances.

Definition

A house Collateral Line of credit (HELOC) is a kind of financing which enables people so you’re able to borrow funds resistant to the security he’s accumulated within property. Guarantee ‘s the difference in the value of the house or property and you can the latest a great equilibrium toward mortgage. With good HELOC, the lender brings a good rotating personal line of credit your debtor is also mark regarding as needed, around a specific limitation.

How it functions

HELOCs work such as credit cards, which have a borrowing limit and you will a good rotating equilibrium. New debtor can also be draw at stake out-of borrowing as needed, as much as the maximum place of the financial. The speed to your a good HELOC is normally changeable and could end up being according to the prime speed or other standard rates. The brand new debtor may have the possibility to decide a fixed appeal speed for all otherwise a portion of the loan.

Advantages

One benefit out of a great HELOC was their freedom. Borrowers is mark at stake off borrowing as needed and you will only pay attract on amount borrowed. That is employed for home owners who have constant expenditures, including renovations otherwise education will set you back. HELOCs may also be used given that a source of emergency cash.

A special advantage of an effective HELOC is the fact its protected from the the property, it is therefore a diminished-chance mortgage to possess lenders. This may end up in down rates than signature loans, such as handmade cards or personal loans. Yet not, consumers should be aware of that if they can’t build the minimum repayments toward financing, they exposure losing their residence.

To qualify for good HELOC, lenders generally want the very least credit score and you will financial obligation-to-earnings proportion, in addition to a lot of security from the possessions. The loan count, draw several months, repayment several months, minimal costs, and you can fee records may differ according to the financial while the borrower’s creditworthiness.

To put it briefly, a great HELOC is a kind of financing that allows residents to help you borrow cash from the guarantee in their assets. It offers freedom, lower rates of interest than simply unsecured loans, which will be shielded of the property. Although not, consumers should know the dangers and requires for the this type of financing.

Do you want an assessment to own a home Collateral Line of Borrowing?

If you’re considering a home collateral line installment loans for bad credit in Hudson IA of credit (HELOC), you’re questioning in the event that an assessment becomes necessary. An assessment is an essential step up our home security loan processes. Within this part, we are going to explore whether you want an assessment to possess an excellent HELOC and exactly what items could affect the latest appraisal procedure.