There are lots of form of home loans for the authorities benefits nowadays. You’ll find loans for very first time home buyers, or mortgages to buy a home and no money down. But did you know that there was a specific regulators-recognized mortgage that really needs zero deposit, very first time homebuyers can be qualify for it, as well as those with down credit ratings, that can be used all over all All of us? It’s titled good USDA Home loan, and the authorities, it will be the perfect solution to have home financing.

What is an effective USDA Mortgage?

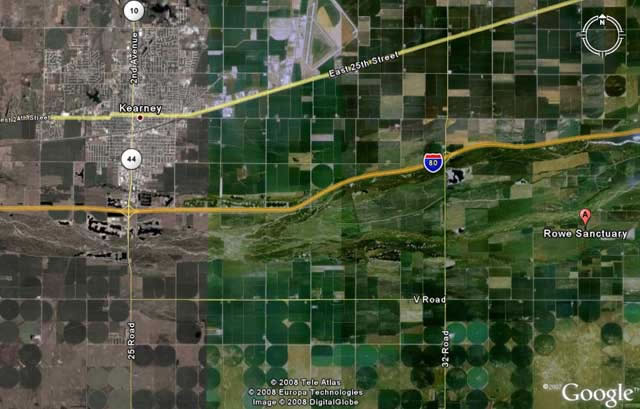

USDA fund is actually an option for the police professionals or other candidates who want to get possessions for the outlying parts. This type of loans try backed, otherwise insured, from the Us Institution out-of Farming (USDA). Brand new USDA describes outlying just like the an urban area with an inhabitants from less than thirty-five,000 someone. Thus, you might think country otherwise farm when you listen to rural, around 97% of your own You homes is simply noticed rural.

With respect to the USDA, these types of mortgage loans support lower- and very-low-earnings candidates get very good, safe, and you can sanitary houses in the eligible rural components by giving payment guidance… Essentially, loans Hollins AL USDA mortgage brokers allow for some one, or a family group, to make low to average earnings as entitled to homeownership. This consists of first-time homebuyers along with people who has actually had house prior to now. One which just end understanding believing that your revenue would not meet the requirements since you make money, consider this. The cash recommendations affect all adults living in the household. So, if the resigned parents accept your, otherwise your grown children are still at your home, the cash tolerance try highest. Discover what the money qualification is during a state.

USDA Home loans to own the authorities give low interest, and don’t need an advance payment. Its ideal for low income earners who happen to be interested in it difficult to create an effective 20% downpayment to possess a house. Also good for somebody which have lower credit which can be incapable in order to qualify for conventional financing.

As interest in law enforcement inside the outlying parts might be highest, you may prefer to go on to a outlying city at some stage in your job. Otherwise, maybe you may be already leasing when you look at the an effective USDA-outlined outlying city and are also looking to purchase a property. USDA Mortgage brokers need not be utilised by earliest big date home buyers both. They’re accustomed generate a property into house, or even to remodel a preexisting home. A USDA mortgage is a good selection for any of these types of condition, for people who be considered.

- Zero called for deposit.

- There’s no punishment for many who pay the mortgage right back sooner or later.

- USDA mortgage brokers has reasonable and you may repaired interest levels.

- Mortgage conditions are 33 many years, meaning you’ve got one enough time to invest the borrowed funds straight back.

- USDA financing don’t possess a card lowest to meet up with, but the majority lenders commonly require a get off 640.

- Loan are often used to create property as well as get a property.

- For individuals who already are now living in a rural town and qualify, these types of financing also may help refinance or renovate your existing domestic.

Standards getting an effective USDA Home loan

USDA mortgages possess very tight conditions that has to most of the getting fulfilled becoming eligible, although not. If you are not sure if your or perhaps the assets you want to get is approved, you should use which unit regarding the USDA to evaluate the newest program insights for the state. You’ll be able to talk to a property to own Heroes loan specialist, that are in a position to take you step-by-step through the needs and you may all your inquiries. Together with, the loan specialists has smaller costs having the police heroes and you may most other heroes including educators, health care gurus, military, EMS, and you may firefighters. This is simply one-way Home getting Heroes can help save you far more on your own house get.