COMPLETE guide to bearer bonds in the U S. 2023

Content

(B) one-half of the amount of funds anticipated to be on hand in the Foundation School Program to make payments for the remainder of the fiscal year. (4) create and maintain a bond reserve fund and other funds as provided in the bond resolution or trust indenture. (e) Bonds constituting a junior lien on the revenue or properties may be issued unless prohibited by the bond resolution or trust indenture. Parity bonds may be issued do bearer bonds expire under conditions specified in the bond resolution or trust indenture. (d) Provisions may be made in the bond resolution or trust indenture for the substitution of new bonds for those lost or mutilated. When bonds are approved by the attorney general and registered by the comptroller, it is not necessary to obtain the approval of the attorney general or registration by the comptroller as to converted or substituted bonds.

(b) The bond resolution or trust indenture may prescribe systems, methods, routines, and procedures under which the stadium shall be operated. (3) “Authority” means an athletic stadium authority created under this subchapter. (j) A certified copy of all proceedings relating to the authorization of the certificates shall be submitted to the attorney general.

Bearer Bond: Definition, How It Works, and Why They’re Valuable

Provide the Court Order establishing the deposit of funds into court and any subsequent court order entered before the delivery of the property to this office. If the property owner is deceased probate documentation will be required. Transfer and Assignment of Interest – to include statement regarding unclaimed funds turned over to NJ. Below is a listing of the phone numbers to the Surrogate Office’s for all 21 New Jersey Counties. Contact the county in which the decedent resided at the time of death (refer to the death certificate). However, if you want someone to act on your behalf following the hearing, you must authorize this in writing.

- In contrast, registered bonds retained the tax-exempt treatment.[7] A challenge to this tax treatment by the US state of South Carolina was heard by the US Supreme Court in the case of South Carolina v. Baker (1988), which upheld the law and brought to an end the further issue of virtually all US municipal bearer bonds.

- (2) pay the remaining principal of and interest on the bonds as the principal and interest become due.

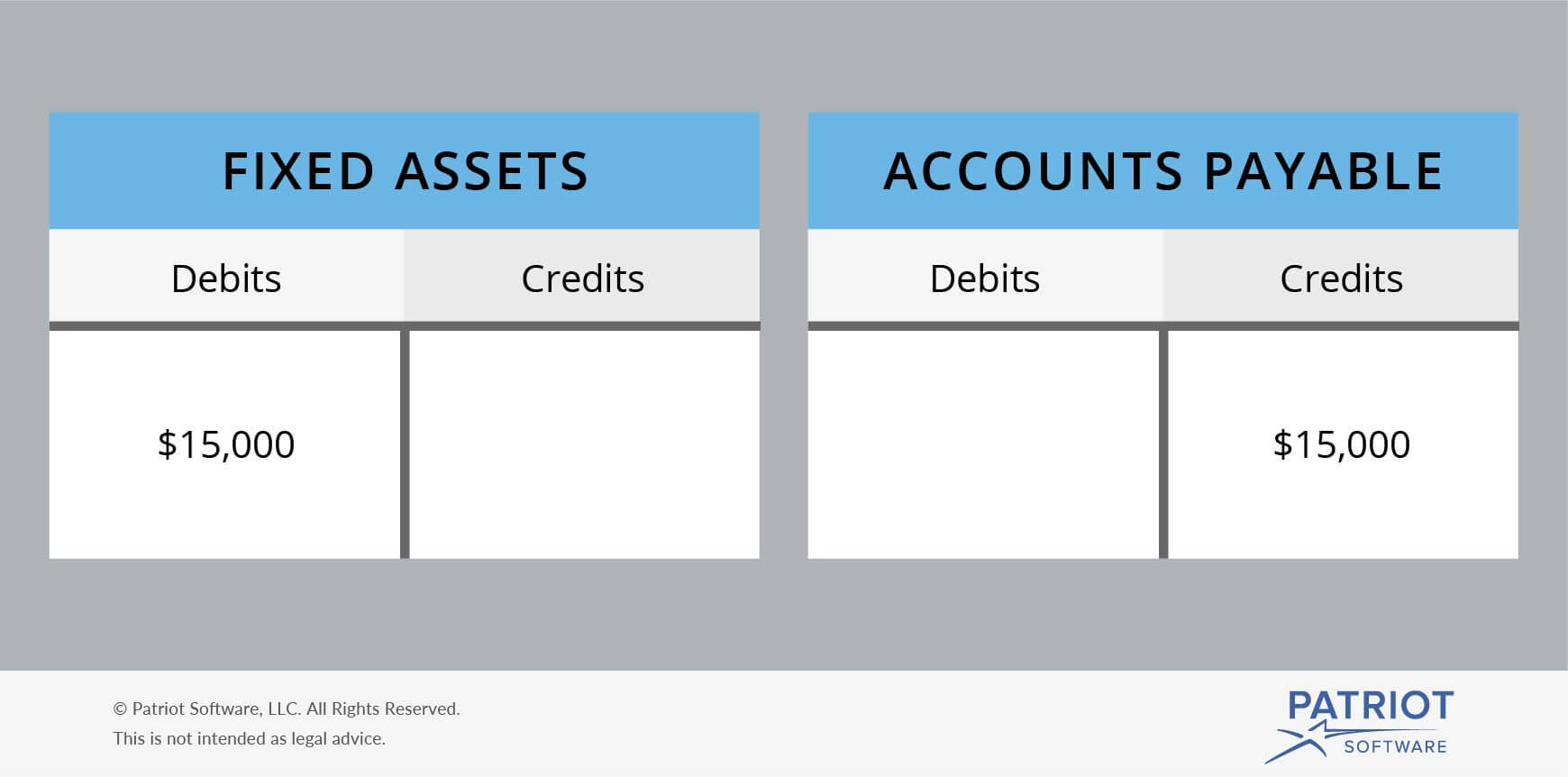

- The face value is the amount the bond issuer promises to pay to the bondholder at maturity.

- (g) Except if issued in exchange for certificates outstanding as provided by Subsection (i), the certificates shall be sold for cash at not less than the face or par value plus accrued interest.

- When appropriate, we might reduce the amount of deficiency during the 29-day period.

(b) This subchapter does not create a debt of the state under the Texas Constitution or, except to the extent provided by this subchapter, create a payment obligation. (f) On reimbursement by a school district as required by this section, the commissioner shall pay to the district any amount withheld under this section. (f) This section does not create a debt of the state under the Texas Constitution or, except to the extent provided by this subchapter, create a payment obligation. (c) The procedures prescribed by Subsections (a) and (b) apply to each payment of principal or interest on bonds as the payment becomes due until the bonds mature or are defeased in accordance with state law. (2) payments of all of the principal of the bonds must be scheduled during the first six months of the state fiscal year. (3) the tying bids or proposals are otherwise equal in the judgment and discretion of the board of trustees of the district.

How to Change the Beneficiary on Series EE Bonds

This can be avoided by attaching proper documentation to the owner’s will. The lack of bond registration offers little protection or recourse to investors if the physical certificate is stolen since the custodians do not have the name of the real owner on file. Submit the original bond/coupon that is listed in the Property Detail section on the enclosed claim packet. Only the original bond/coupon, not photocopies, will result in a successful claim submission. Bearer bonds are similar to currency/cash, they can only be redeemed when the original instrument is present.

(2) the authority of the district to levy the additional ad valorem taxes expires when the bonds are paid in full or the judgment is paid, whichever occurs later. (B) redeem any bonds being refunded before maturity, including principal, any required redemption premium, and the interest to accrue on the bonds to the redemption date. (2) “Total debt service” means the amount of principal and unpaid interest on a bond to final maturity. If you bought bonds when originally issued, and thus paid face value, you may be subject to unwanted capital gains taxes.

After you receive your NODD

Based on that analysis, the state auditor shall certify whether the amount of bonds guaranteed under this subchapter is within the limit prescribed by this section. (4) post on the agency’s Internet website a list of each school district the agency has determined to have https://personal-accounting.org/what-is-petty-cash/ adopted a maintenance tax rate in violation of Subsection (a). If you are reporting bearer bonds or unclaimed interest on such bonds, the complete description of the bonds must include the issue name, series, and bond number, as well as all outstanding coupon numbers.

What are the 3 types of Treasury bonds?

- Treasury bonds, notes and bills are three different types of U.S. debt securities.

- They vary in their length to maturity (the time it takes to receive the face value) and the interest rates they pay.

- Treasury bills mature in less than one year, Treasury notes in two to five years and Treasury bonds in 20 or 30 years.

For instance, since there are no records attached to bearer bonds, there is no way in which you can recover it if you lose it. Disasters such as fires or floods can therefore prove to be devastating in terms of loss. It is impossible to trace a bearer bond, which means that you might not get it back once it has been stolen. Coupons that have been lost in the mail also pose a problem for interest payments. The lack of documentation makes it difficult for the heirs of the owners of bearer bonds as well.