Violations of Utah Business Law

Violations of Utah Business Law

It is very important to understand the violations Utah business law. Learn about them below.

- Definition: Business law consists of the state/federal rights and laws related to create, run, manage, close and sell one’s business. Businesses in Utah must obey federal, state and local laws in order to legally create and run their business.

- Business License: The purpose of a business having a license is to inform the government that the business will be making a profit from customers and that the business gets properly taxed. The license is also to inform the government that the type of business management and owners have the proper training in the field of business they are in. Obtaining a business license is simple: apply to the government to obtain one.

- Failure to obtain or practice without a business license can result in having to pay a fine, be suspended from practicing one’s business or face criminal charges. One or many of these may happen to one’s business if they are found practicing without a license – this a violation of Utah business law.

- Antitrust laws protect a business from unfair competition. These laws are established by the government in the open market. The reason for antitrust laws is to benefit the customer welfare.There are activities included in business laws:

- Market Allocation has certain boundaries set to stay in and avoid. For example, two similar businesses might agree to stay away from each other’s boundaries in order to keep the competition fair.

- Price Fixing: Two companies might have very similar products, excluding the price. In order to keep the competition fair, these two companies may agree on a fixed price for their product.

- Deceptive Trade Practice (violations Utah business law):

- Acts such as falsely advertising goods or services with the intent to mislead or manipulate customers are illegal in Utah (see Utah Code 13- 11a-3). This means that the act of manipulation or theft in a business setting that affects commerce is illegal.

- For example, a business misleading customers into buying a false or phony product they advertise. “False advertising and odometer tampering are two of the most blatant examples of commercial fraud” (Findlaw, Details on State Deceptive Trade Practices).

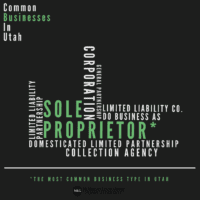

- Starting a Business in Utah: If a person or group is going to start a business in Utah, they must register with the Utah Department of Commerce (DBA). Most businesses also must be licensed to practice their business in the county their business is in. Businesses must register with the state so other business can refer to their information held so they know who they are doing business with. Businesses must be licensed to practice their business in the county because of regulations that county has. For example, a business cannot sell drones in a county that has banned them.

- Securities Fraud: A Security is someone’s investment in stocks, bonds, promissory notes, limited partnership interests, LLC interests, oil and gas partnerships (UDC, Division of Securities). Protecting one’s security is difficult, especially when someone is trying to handle it themselves. An “Investment Contract” is any transaction where the money will be returned for profit. This can also be considered part of one’s Security (UUSA, 61-1-13).

- Not having a current business license while practicing (violations Utah business law)

- Deceptive Trade Practice (violations Utah business law)

- Securities fraud (violations Utah business law)