Axis Financial knows the necessity of delivering flexible cost choices to their people

With the help of our diverse steps, individuals can pick the possibility you to definitely best suits its comfort and financial predicament. It’s best to possess consumers to choose the cost solution you to aligns with regards to standards and you can guarantees timely installment of the Axis Mortgage.

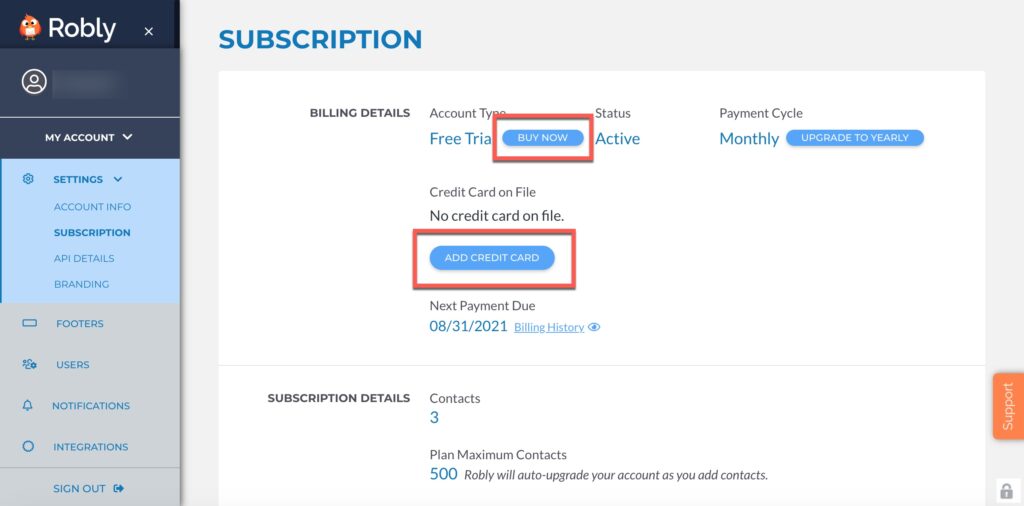

Axis Bank loan Application Process

Making an application for financing with Axis Financial is a simple and you can easy processes. Whether or not you desire a consumer loan, mortgage, or car loan, Axis Bank has your protected. The following is a jump-by-action publication on precisely how to sign up for a keen Axis Mortgage:

1. Lookup

The initial step would be to research and you can examine the many brands from finance given by Axis Lender. Dictate the borrowed funds matter need, the eye costs, and also the payment period that suits the money you owe.

2. Collect Data files

Once you’ve chosen the kind of mortgage, collect all the necessary data you’ll need for the loan application. This may include label facts, address evidence, money research, or other relevant data. Having such documents in a position often speed up the mortgage application techniques.

twenty-three. Online App

Go to the specialized Axis Lender webpages and you may navigate to the financing app page. Read more