During the refinancing process, the lender will track down and always check the term regarding government records

Keep in mind that each homeowners’ motives in order to have their home loan refinanced, and you will what they desire in the refinancing, should be nuanced, and is rarely a cut out-and-lifeless material. Do some data which can be suitable for your unique problem and you can be truthful that have yourself about much time you want to remain of your house. Undertaking those two things will help you assess whether a beneficial no-closing-costs choice is really the most useful course of action for the refinancing mortgage.

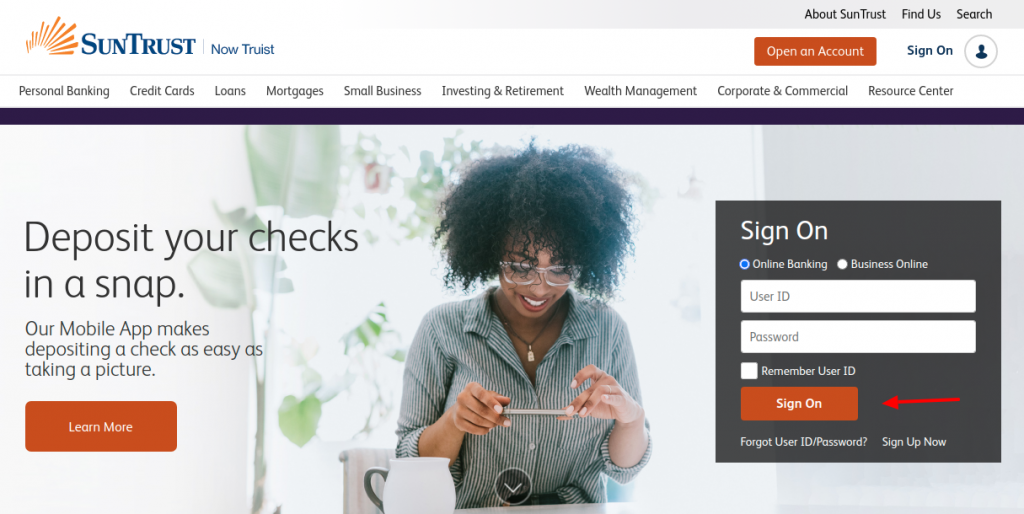

Sign up for A home loan Re-finance

The mortgage refinancing process can be, understandably, getting complicated and you can daunting. For people that especially worried about saving money and you may cutting brand new economic weight of the home loan, it may be difficult to know whether or not a zero-closing-pricing refinancing is actually the most suitable choice. Thankfully, masters particularly Promise Monetary offer effective, professional refinancing functions and certainly will work with you along each step out-of the mortgage refinancing techniques

Identity insurance exists to protect the financial institution, as well as on occasion, your, the fresh new citizen, also

Promise Economic prides itself to the the anybody-first, service-oriented way of property and you may refinancing mortgage, certainly most other functions. Our company is another, full-service domestic financial banker. Customers can seem to be confident in the possibilities and you can feel. Just like the supplier/servicer acknowledged having Fannie mae and you may Freddie Mac, and you may issuer-recognized for Ginnie Mae, we could underwrite everyone inside the-house you should not care about outsourcing the loan info. Read more