You can Finance a cellular House with a mortgage, But Arounds a catch

Mobile, are built, and standard property is actually well-known choices for consumers site trying to find the fresh new tiny household way and those incapable of manage to buy an effective conventional household. In the event the such strange property interest your, you’ll receive a mortgage loan purchasing one. However, the brand new connect would be the fact of numerous loan providers may need one to individual or choose the home and you may forever add your home so you’re able to they so you can qualify for a normal mortgage.

Key Takeaways

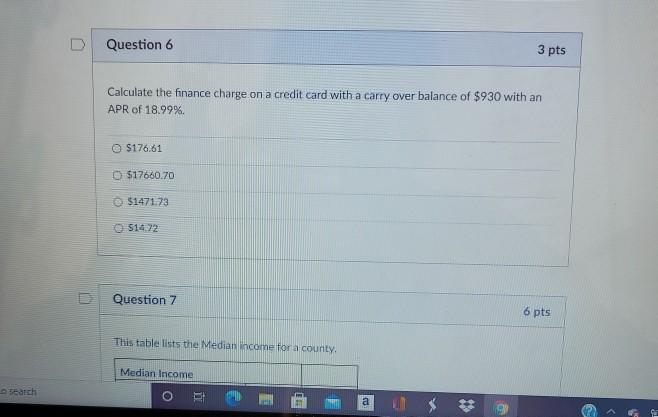

- Cellular, are designed, and you can standard belongings enjoys numerous money solutions.

- Investment are readily available from name brand, regional credit unions, otherwise expertise lenders.

- Financing options including You.S. Agencies of Veterans Factors (VA) funds, U.S. Service out-of Agriculture (USDA) financing, and Government Houses Administration (FHA) funds come toward are available homes.

- You need to use home financing buying one another a cellular, are formulated, or modular household and the house meanwhile.

- Of numerous consumers sign up for chattel fund, which may be more expensive than just a mortgage.

Kind of Mobile House

The expression cellular household pertains to a number of homes that are not commercially cellular. There’s two most other subcategories: are available land and modular belongings.

Cellular Home

It’s mobile residential property is actually mobile. Smaller households, travel trailers in which anybody real time, and you may converted vehicles are officially mobile property. Structures which were facility-built prior to U.S. Agency of Construction and you may Metropolitan Invention (HUD) password conditions have been created in 1976 was cellular homes. Read more