Want to refinance their financial but worried you’re going to be declined? Observe how a lender usually assess your house loan refinance software.

An educated action you might get initial will be to work at a certified lending expert exactly who just knows your targets, however, who is educated inside borrowing from the bank and you may sincere throughout discussions.

Both you’ll be able to pay attention to stuff you don’t like but never carry it physically! A financing specialist’s mission is to obtain the best effects for you considering your personal circumstances.

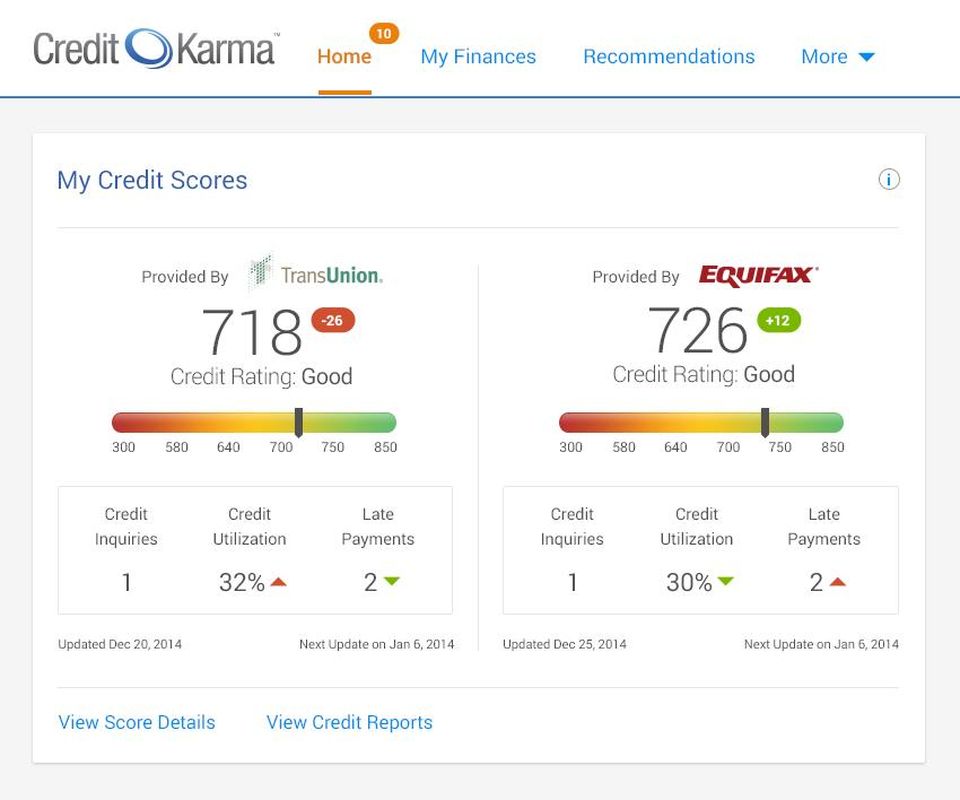

Your credit score is simply too low

When you apply at refinance your residence mortgage, you are generally applying for a whole new financial. That means a loan provider have a tendency to assess the job utilizing the same conditions they’d to other lenders. Plus one of the most important circumstances they think will be your credit score.

Your credit score generally scratches your about in control youre having money and you may considers any credit infractions, decisions or bankruptcies. What’s more, it talks about how frequently you’ve taken out borrowing and you may whether you’re appointment their credit card and personal loan costs into time.

Your credit rating change over time, so it is likely that your own will be different today to help you after you took out your latest financial.

In the event the credit rating is holding you back, you could potentially take the appropriate steps to fix they on your own. Complete with repaying anything you owe, making certain that you see their month-to-month costs of the future and you may to stop applying for credit aside from your refinanced home loan.

Debt situations keeps changed

And when a loan provider assesses an application, they always consider your capability to fulfill your loan payments. It means looking at your revenue, in addition to income and you will bonuses while the money you will get of people opportunities. When you’re refinancing to assist get a residential property a lender have a tendency to factor in one most likely rent you’re going to get from this in addition to.

In case the earnings has actually decrease as you past taken out a mortgage, you will possibly not manage to use as much as past go out in which case, a lender get reject their re-finance software.

If the factors keeps changed just temporarily for-instance, if you are out from the staff members into adult log off otherwise with a position crack you could allow yourself a far greater risk of qualifying by waiting unless you go back to work before you apply so you’re able to refinance.

Rather, if for example the money possess reduced forever, you will be able to extend the new regards to the loan to attenuate your loan repayments. As you will probably be much better in a position to satisfy these types of money, it may also replace your possibility of being approved.

The cost of living are too large

Loan providers wouldn’t merely view what is actually being received by your finances they will certainly think about what’s leaving they. If the bills is high, this will affect what you can do discover that loan.

Loan providers was particularly concerned with one low-negotiables you need to pay getting, such as the price of raising college students. Therefore, if you have a great deal more dependents than simply last go out your applied for that loan, they’re going to keep this in mind.

They will including assess what you are paying for products such child care, lingering lease, studies, resources and you may activities. To quit good refinancing rejection, it’s important which you live within your mode and you may cut back towards way too many expenses if you wish to.

This is an essential area to find right once the lenders can get browse your exchange statements to ensure costs. Credit gurus (LJ Hooker Lenders as an instance) gain access to technology that can digitally read their comments and you can offer you reveal research.

You may have excessive financial obligation

For the financial, assessing what is leaving your finances involves more than simply evaluating your own living can cost you. They will including reason for almost every other credit you can access, along with signature loans and you may credit cards even though you don’t owe anything on them.

To greatly help avoid being refused, you might close down any playing cards you’re not having fun with. It is possible to prefer to combine any personal loans or borrowing from the bank card debt https://elitecashadvance.com/personal-loans-oh/ to your refinanced mortgage and that means you dont enjoys most other higher-desire loans outside of your own financial.

Their LVR is just too large

One of the most tactics a lender often believe when your affect re-finance your residence financing can be your mortgage-to-value proportion (LVR).

While refinancing to acquire a residential property, your own LVR is certainly going up, just like the one equity you really have of your home usually today be regularly safer a couple of features. If the markets features decrease since your history application and you also have not paid off most of the borrowed funds dominating, their LVR may have risen as well.

If for example the LVR on your own refinance application is excessive, a loan provider get deny the application or request you to need out lenders mortgage insurance coverage (LMI).

The significance of knowing the refinancing process

Prior to making a mortgage refinance application it is critical to understand the refinancing procedure and also sensible from simply how much you can use. This way you’re likely to stop getting your app declined.

Therefore good first step before applying for a financial loan are in order to always identify a financing professional. Might assist increase your chances of being qualified of the permitting you earn the application under control. They will certainly as well as do an entire initial post on your financial status to be certain you are trying to get the proper unit.

The audience is a real alternative to banking institutions, with regional financing experts exactly who give personalised home loan pointers to help you produce a good choice.