By the refinancing to help you a longer term, there are straight down monthly installments. But you’ll be making such money for a bit longer and ultimately spending way more appeal. Still, that is beneficial if other expenditures on the month-to-month finances have left right up or you has actually almost every other funding possibilities you desire to understand more about.

What you need knowing

This is exactly a large choice. When you first ordered our home you truly envision you had been over considering mortgages, rates as well as one to. However, as with of several monetary choices, it’s best to help you review your own mortgage disease making yes it’s still in your best interest.

There are various things you must know whenever choosing whether or not to refinance. They’ve been your current financial dimensions, the newest home loan you will be taking out fully, the present day house worth, the modern rate of interest of loan, the new interest additionally the closing costs.

Okay, therefore Ought i Refinance?

To see if refinancing makes sense for you, test good refinance calculator. You enter some particular recommendations together with re-finance calculator identifies just what helps to make the most experience to suit your style of state. Then you may even mess around a little bit observe just what items would alter the guidance.

A portion of the matter you want to out to own is the area if monthly offers of one’s the newest financial end up being higher than the fresh new up-front will set you back of refinancing. Put differently, just how long will it elevates to recuperate the new costs you reduced to accomplish brand new re-finance? If that number is within the timeframe you plan with the being in the house, you’ll be able to re-finance. If you are intending to the attempting to sell in the future, refinancing might not be beneficial.

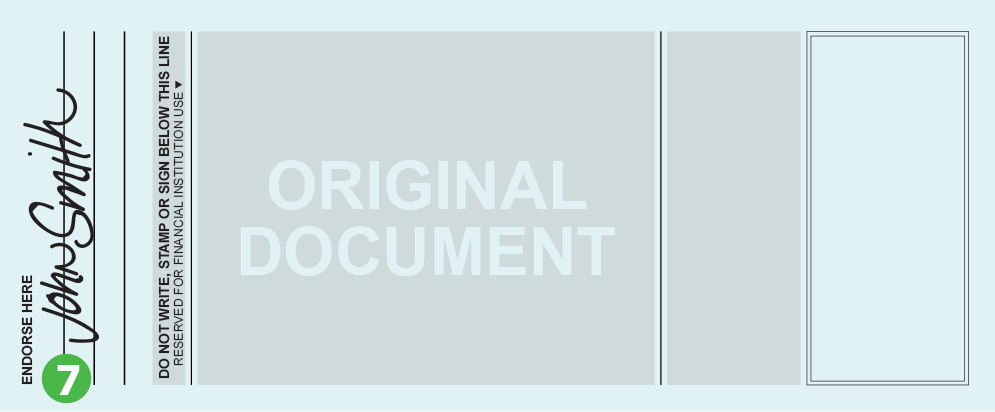

A great refinance calculator (for instance the SmartAsset you to definitely more than, happy you!) will show you the two problems maintaining your newest home loan and getting yet payday loans Megargel another one. Then you can find out how their payment might possibly be inspired and just how much you will definitely spend in closing costs. This also means that essential schedule based on how enough time your need to take care of the new home loan to keep enough money to help you defense this new upwards-top can cost you. Essentially, this is basically the part when you start in reality spending less.

When you should Re-finance

In the 2007 (the fresh peak of one’s present “houses ripple”), the common interest into the a 30-year mortgage are 6.34%. At the time of , you to definitely rates is about step three.8%. So there was a spin you could discover a giant drop when you look at the your own interest of the refinancing. As much as possible today be eligible for less-attention mortgage, it will save you way too much currency more than an effective 15- otherwise 31-year financial. Refinancing can make so much more feel than and also make even more money during the your existing interest.

It isn’t merely interest rates one to change, though. You’ve probably altered sometime since you had the mortgage since the really. If you’ve grown not only earlier, but smarter too, you have got increased your credit rating. This means that you might have obtained a good credit score prior to, now that you’ve Expert credit, it is possible to qualify for a better interest rate.

A special sign that you need to end up being refinancing is if need to switch new terms and conditions on the financial. An example from the is the period of the borrowed funds, and this we touched into just before. You can aquire an extended financial and also make monthly installments faster or a smaller mortgage to attenuate overall will set you back. You could together with key out of a changeable-rate mortgage so you can a fixed price. If you are watching a decreased rates together with your Sleeve but so now you wanted some balance, you can make use of an effective re-finance once the a chance to secure a predetermined rate.