Understanding the Difference in Lenders and you may Financing Originators

With so many some other headings and you try this site may perform during the mortgage industry, it’s not hard to confuse the latest responsibilities that each retains. When you are Home loan Originators and you can Home mortgage Officials (MLOs) was essentially the same part, it differ mostly from a large financial company. Area of the difference in such headings would be the fact Mortgage brokers is actually utilized by a sponsoring Agent, while Home loan Originators and you will Officials have employment with a lender or mortgage lender. Both Mortgage brokers and MLOs are authorized nationally of the All over the country Multistate Certification System (NMLS). This informative guide tend to plunge deeper on the exactly what a mortgage broker is and you can why are you to term different from other home loan gurus.

What is a mortgage broker?

A mortgage broker acts as a middleman between your homebuyer and you can lender, as well as need certainly to promote most of the got its start funds for some body or companies. They offer mortgages through several dealers otherwise banking companies, operating on a payment and you can fee foundation just. A mortgage broker needs a loan application and you may send they out over multiple you can financial institutions or mortgage people before you choose the best offer.

Typically, financial institutions or other mortgage credit organizations possess marketed her affairs, however, due to the fact marketplace for mortgage loans is more competitive, this new character of your own Mortgage broker has-been much more popular. Lenders will always be utilized by a brokerage rather than an effective lender, making them unable to approve or refuse a loan.

What do Mortgage brokers Create?

Which have a flexible agenda and you can all types of more jobs, Home loans arrive at see new things every single day. When you find yourself their head employment duty is to obtain an educated financial option for their customers, there clearly was alot more you to definitely gets into its everyday requirements. The following is a listing of a few of the obligations questioned out-of a large financial company:

- Interest clients

- Determine borrower’s facts

- Become familiar with the market industry to find the best home loan product towards buyer

- Read courtroom disclosures having customers

- Complete lender application forms

- Refinance mortgage financing

- Complete requisite information toward financial

How Is actually Home loans Paid off?

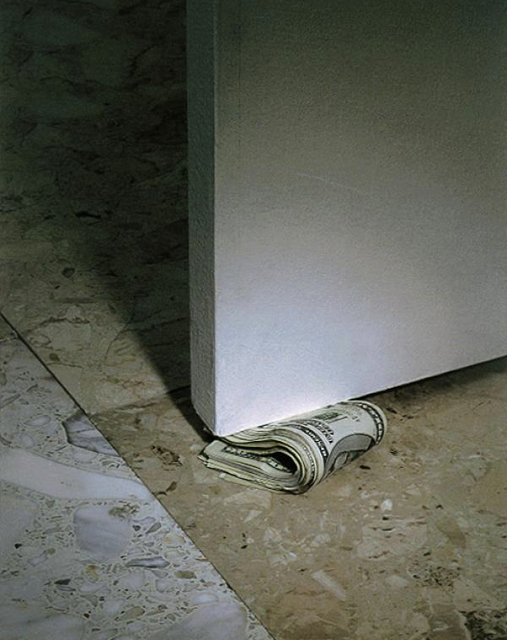

Lenders is actually paid back due to commissions and you may charge, tend to billing around 1-2% of your loan amount. It commission is set in the loan number otherwise paid initial by the debtor or the lender, and is also flexible. Home loans have to disclose every charge upfront, and they’re just in a position to costs the quantity expose. Except if he could be paid down initial, Lenders are often repaid following deal is actually finalized.

Such, a brokerage deal a $five-hundred,000 loan. The help of its step 1-2% fee, they stand to earn $5,000-$ten,000 on that financing.

Within the , this new Dodd-Honest Wall Road Change and User Protection Act was put in location to change economic regulation responding towards Higher Recession. That it Work restructured exactly how Lenders was paid and place statutes set up to safeguard members, which previously got little safety. In Dodd-Honest Act you will find Term XIV, the mortgage Reform and you will Anti-Predatory Credit Work, hence says that Lenders never:

- Charge hidden charge

- Wrap their shell out to your loan’s rate of interest

What is a loan Originator?

A mortgage loan Founder, often referred to as a keen MLO, is actually a financial top-notch exactly who facilitate homeowners which have a mortgage app to locate fund when buying possessions, while also creating loan origination due to their members. MLOs works directly which have real estate professionals, helping consumers field the newest monetary side of a home purchase. While you are Home loans work with a brokerage, Mortgage Originators are utilized by a bank otherwise home loan organization.