For the majority Low-Resident Indians (NRIs), having an article of its homeland is actually a dream. Having India’s market burgeoning, the prospect of buying property here is much more attractive. But how does you to browse so it road out-of thousands of kilometers out? This web site simplifies the process of getting NRI mortgage brokers, a crucial step for the to find assets inside the Asia.

As to the reasons India is actually a nice-looking Market for NRIs

India’s a house industry has actually seen exponential growth, offering lucrative resource ventures. Products such a booming cost savings, diverse property versions, and sentimental well worth make Asia a premier selection for NRIs. Additionally, many NRIs look at property from inside the India given that a secure asset to possess the old-age ages or due to the fact a bottom for their family.

Qualification Conditions to own NRI Home loans

Prior to plunge towards the field, knowing the qualifications requirements getting lenders is vital. Fundamentally, Indian finance companies think years, a position position, and you will income balances. NRIs generally speaking need to be utilized for a specific several months into the the nation of its residence and now have a stable income source.

Requisite Records

The fresh new documentation process to possess NRIs is much more stringent than for resident Indians. Key records are passport and you may charge duplicates, to another country work details, income slides, and NRE/NRO family savings comments. Banking institutions can also require a power out-of lawyer, providing a realtor inside the India to manage purchases.

Types of Functions NRIs Can Spend money on

NRIs can buy the majority of form of possessions in the Asia but agricultural home, farmhouses, and you may plantation functions. Insights which limitation is very important to end judge obstacles.

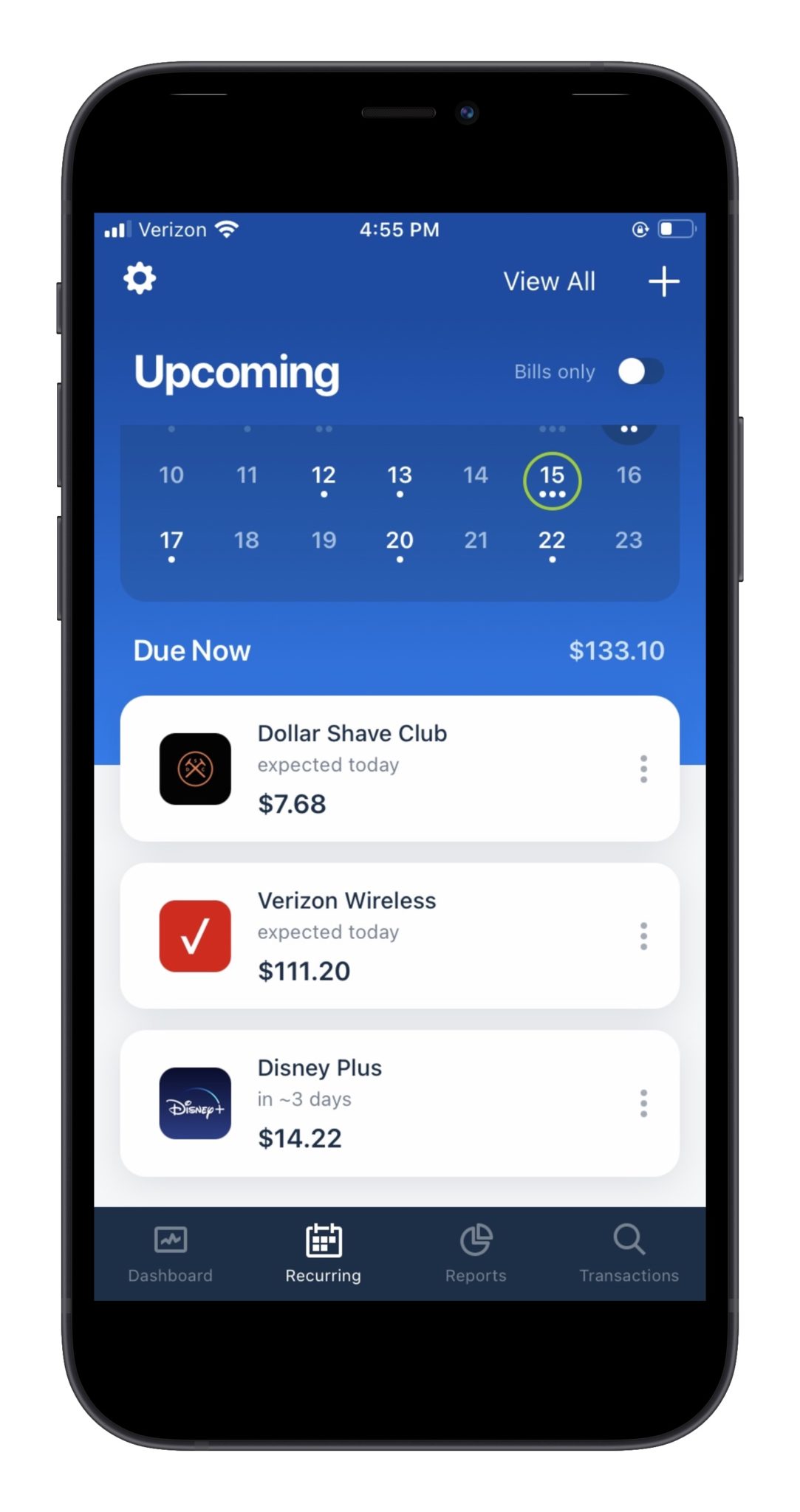

Loan Has actually and you may Professionals

NRI lenders incorporate have particularly attractive interest rates, versatile tenure, and also the selection for a shared financing. The loan count usually relies on the person’s earnings and you may property well worth. Some banking companies supply unique masters particularly online membership government.

Taxation Effects to possess NRIs

Investing Indian a house boasts their number of income tax effects. NRIs should be aware of taxation, money progress income tax, and you can local rental tax during the India. There are also benefits significantly less than certain chapters of the amount of money Taxation Act, which is leveraged.

Repatriation of Loans

Knowing the repatriation regulations is key. The latest Put aside Bank regarding India allows NRIs so you’re able to repatriate funds around particular standards, that should be well understood to ensure conformity and you may easier funding.

Selecting the most appropriate Bank otherwise Lender

Deciding on the best bank is just as very important just like the deciding on the best property. Factors for example interest levels, financing tenure, processing costs, and customer service enjoy a life threatening character contained in this decision.

The whole process of Applying for and getting financing

The borrowed funds app procedure relates to distribution the application form that have needed records, possessions verification, loan sanction, ultimately, the borrowed funds disbursement. Its a structured process that need focus on outline.

Court Considerations and you may Homework

Court homework cannot be overstated. NRIs would be to verify clear property titles, legitimate building permits, and an established builder. Seeking legal advice is usually a smart action.To purchase possessions when you look at the India given that a keen NRI is a huge financial and mental decision. Once the techniques may seem challenging, understanding the nuances away from NRI home loans is also express they. You may choose to accomplish comprehensive research and you may consult monetary and you may courtroom pros and come up with which travel effortless and satisfying. For the right strategy, owning an aspiration domestic inside India is unquestionably within reach getting the global Indian people.

Faqs regarding the NRI Lenders

Here’s the variety of files necessary for an NRI to have a financial:Passport and you will visa copiesProof from quarters abroadEmployment payday loan no fax and you can money data such income slips, bank comments, and you will a position contractProperty-relevant documents for instance the title deed, NOC, and you can contract regarding saleAdditional documents may be needed according to the lender.

Yes, NRIs can pay off the borrowed funds inside their local currency. This new repayment is commonly complete compliment of Non-Resident Additional (NRE) or Low-Resident Ordinary (NRO) membership.

The mortgage tenure may differ by lender but generally speaking selections off 5 so you’re able to 3 decades. Age the latest applicant and retirement can also be influence the latest tenure.

Rates getting NRI lenders are different from the financial and you may industry criteria. They are usually a bit higher than men and women getting resident Indians. The brand new rates might possibly be fixed otherwise drifting, depending on the lender’s offering.

For those who standard towards a keen NRI mortgage, the effects are like those people encountered of the citizen individuals. The financial institution have a tendency to initially send reminders and observes having delinquent payments. Proceeded standard can lead to legal action, including the initiation regarding recovery steps under the SARFAESI Operate. The home would be caught and you will auctioned to recover the mortgage matter. In addition, defaulting for the a loan negatively affects your credit rating, affecting your ability in order to secure funds later on, in Asia and maybe on your nation away from quarters.

The fresh new restrict of a keen NRI financial hinges on individuals things for instance the borrower’s money, payment ability, additionally the property’s really worth. Fundamentally, banking companies for the Asia funds around 80-85% of your property’s really worth to own NRIs. The exact count can differ anywhere between banking institutions which can be calculated built to your NRI’s income, the kind of property being ordered, and other qualification requirements lay of the financial.

Yes, NRIs can claim a mortgage for the Asia. He is entitled to taxation masters toward home loan repayments comparable so you’re able to Indian owners. Such professionals include write-offs not as much as Part 24 for attract paid off towards the mortgage and you can below Part 80C towards dominating cost. Although not, to help you avail of such positives, the fresh new NRI must document taxation production inside the India in the event the their earnings within the India exceeds the fundamental exemption restrict. They need to in addition to conform to brand new Foreign exchange Management Work (FEMA) regulations.