- Repaired interest rates: Once the house security fund will often have fixed cost, the speed you can get is likely the rate you’ll be able to remain from longevity of the loan, creating predictable payments each month.

Disadvantages of Home Guarantee Money

- You can risk foreclosures: Having a home security financing, the money is covered through the security of your property. This gives your own lender good lien, or court allege, more than your home. For many who default in your loan otherwise are unable to generate money, the lender may start the latest foreclosure techniques while you can expect to treat your residence.

- You want an effective-to-advanced borrowing from the bank: Since you bring guarantee, it’s still more than likely you’ll get less interest than the signature loans, however the welfare pricing can sometimes go to people that have the best borrowing from the bank certification.

- You prefer big equity of your property: With respect to the amount of money youre trying and the lender’s restrict mutual mortgage-to-really worth ratio, the latest guarantee needed to qualify for the borrowed funds may be ample.

Select household equity fund, first mortgage guarantee funds, otherwise domestic guarantee personal lines of credit so you can renovate, or redesign, shell out university fees, or consolidate debt. Any type of their preparations, Huntington can deal with financial choices, security solutions, plus so you can reach finally your specifications.

What is property collateral line of credit?

A beneficial HELOC try a beneficial rotating personal line of credit, similar to a credit card. You can easily make an application for the fresh new line of credit which have a lender and you may, in the event that acknowledged, it is possible to access money anytime using your mark several months, up to a predetermined limit. HELOCs can be helpful if you don’t know precisely how much cash money you want or you desire to be happy to pay down varying expenditures. If you’re planning an enormous enterprise and will spread out expenditures during the period of an entire 12 months, a great HELOC can make sense while the you can take-out fund as you need all of them.

Why does an effective HELOC performs?

While acknowledged to possess an effective HELOC, you have accessibility a revolving line of credit in order to acquire up against your own preset limitation, pay a percentage otherwise all of your equilibrium, and you will do this again. Having an effective HELOC, the mortgage operates in two stages. Earliest, you’ll be able to enter a suck period. Draw periods lasts up to ten years, but not this will are different with regards to the regards to your unique mortgage. In mark months, you’ll have endless availability-up to your overall limit-to invest the bucks because you favor. You’ll likely need to pay an interest-merely percentage inside the mark several months, however will never be required to shell out to your dominant up to the draw period ends up.

After the mark months, you’ll get into stage one or two, that is cost. You can not any longer make any withdrawals using this HELOC and you can you’ll be able to today build typical costs with the both bad credit installment loans direct lender New Jersey the principal you owe and you will interest, creating your payment to boost notably than the appeal-simply costs generated during the draw months.

HELOCs often have a varying interest, for example because the industry speed fluctuates, the rate on your HELOC tend to, as well. This can make it tough to budget monthly.

HELOC Calculator

Is actually the HELOC financial calculator if you are considering a great HELOC so you’re able to consolidate higher-appeal personal debt. Use the electronic equipment in order to examine your current month-to-month money to what their payment per month and coupons was having a beneficial HELOC.

Points to consider Prior to getting a great HELOC

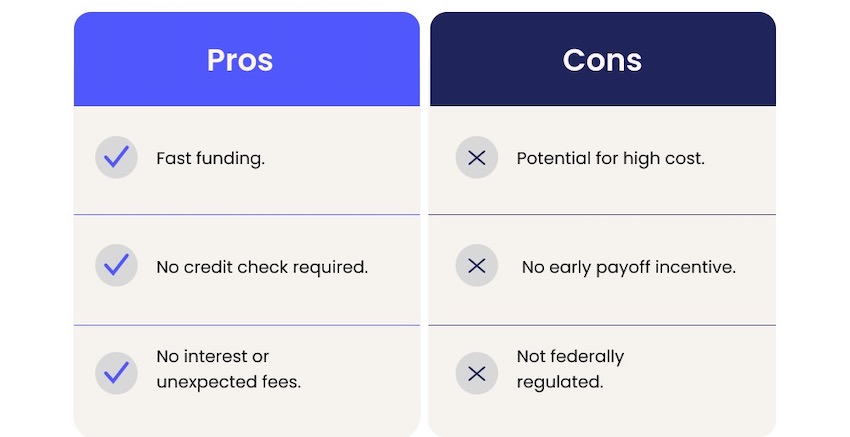

HELOCs could be a beneficial selection for property owners because it allows you to spend some money since you need it, but such as for example home security loans, it’s important to comprehend the advantages and disadvantages of HELOCs.