- Cambridge Providers English Dictionary. (letter.d.). Household guarantee. Recovered of

- Investopedia. (2021). Family Collateral Loan. Retrieved out of

Application Process and Needed Paperwork

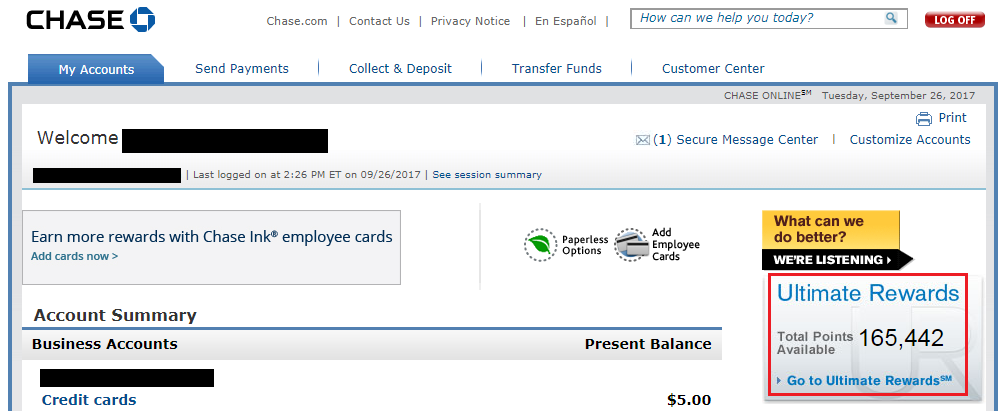

The applying process to have home equity financing typically starts with an effective thorough testing of borrower’s finances, plus credit history, earnings, and an excellent debts. Lenders may also assess the property’s latest ount off security the brand new citizen has generated right up. Because the preliminary assessment is finished, consumers must fill out individuals files to help with their app. Such data files essentially include evidence of money, like present spend stubs otherwise tax statements, and you can proof of possessions, such as financial statements or resource account statements. As well, individuals ought to provide documents associated with the house or property, for instance the mortgage report, property tax bill, and you will homeowners insurance policy. In many cases, lenders also can wanted an expert appraisal of the house to determine its current market really worth. Pursuing the distribution of all the expected documents, the lending company have a tendency to comment the program and make a choice on whether to accept the borrowed funds. If approved, brand new debtor and bank commonly agree on the borrowed funds terminology, as well as rates of interest and you may fees agenda, before finalizing brand new arrangement (Cambridge Company English Dictionary, letter.d.; Wikipedia, n.d.).

Rates of interest and you may Financing Conditions

Rates and you will mortgage conditions getting house guarantee money are influenced from the a number of items. First, the new borrower’s credit rating performs a critical role, as the individuals with higher fico scores are believed less risky and are thus considering a whole lot more beneficial rates of interest. In addition, the mortgage-to-value (LTV) ratio, which is the percentage of the new residence’s really worth are borrowed, influences the speed and you may mortgage terminology. A lesser LTV ratio typically results in ideal conditions, because implies a reduced chance on lender.

Financial things, including the overall health of your savings and the prevailing rates set by main banking institutions, also connect with family equity mortgage words. money loan in Haines City Within the symptoms out of financial increases and you will balances, rates include lower, whenever you are throughout monetary downturns, pricing ong lenders can determine the attention costs and you may words offered, once the loan providers try and desire consumers which have attractive financing bundles. Finally, the length of the loan identity can affect the interest rate, with faster-label fund basically that have down prices than just extended-name loans, because the lender’s risk exposure are faster more a smaller several months (Investopedia, n.d.; Bankrate, letter.d.).

Home guarantee funds give several benefits, and additionally seemingly straight down rates of interest than the personal loans, since they are secured from the borrower’s possessions. This makes them a stylish selection for residents seeking to fund large expenditures, particularly renovations or debt consolidation. While doing so, the attention repaid with the domestic equity financing tends to be taxation-deductible in some points, further reducing the total cost out-of borrowing from the bank (Cambridge Business English Dictionary).

Yet not, there are also drawbacks of this house collateral funds. The biggest chance ‘s the potential death of a person’s home in the event your borrower defaults for the financing, as bank provides the legal right in order to foreclose towards the assets to recuperate their losses. In addition, individuals get deal with a lot more will cost you, instance closure fees and you may appraisal charge, which can increase the overall cost of loan. Finally, home equity funds may not be right for individuals with unstable income otherwise less than perfect credit history, as they get be unable to meet the eligibility standards and you may secure beneficial loan words (Wikipedia).

To close out, household collateral money are a beneficial economic tool getting residents, even so they plus bring built-in threats and will cost you that really must be cautiously experienced just before continuing using this type of type of borrowing from the bank.

- Cambridge Organization English Dictionary. (n.d.). Home equity. Recovered away from