For the majority homebuyers, good fixer-top is the notion of a dream home. However, the procedure of purchasing a fixer-higher comes with extra duties compared to features inside best updates or the fresh new construction home. Finding your way through the process relates to starting a remodeling bundle, knowing what to find when looking for posts, and you can wisdom what investment options are available.

Planning an excellent Fixer-Higher

Fixer-uppers wanted the next-centered mindset. Knowing the magnitude of one’s systems both you and your home is happy to deal with can help setting your budget and their requirement down the road. With a few very first costs data for all the offered endeavor, you’ll have to select should it be worth it to invest in the fresh content oneself and you will do so Diy otherwise hire an expert. Whenever investigations the new seas to possess top-notch remodeling, score certain estimates to contrast will cost you anywhere between builders. Understand that along with the downpayment and closing charge, the expense in a great fixer-top purchase could potentially go over-finances with ease. Learn enabling in your area knowing tips browse any courtroom roadblocks throughout the recovery process also to finest determine your timeline for your house improvement systems.

Seeking a Fixer-Higher

- Location: Regardless if you are to order an excellent fixer-higher having plans to sell it, book it, otherwise are now living in they, think its place before buying. If you are intending to your selling otherwise renting, venue the most tactics to make a great return on your investment. And if you are attending are now living in the fixer-higher, remember that place would-be a corner from their expertise in the house. If you are looking to offer sooner or later, talk to your broker to understand highest Return on your investment building work plans one usually pique client need for your neighborhood.

- Range regarding Repair: If you are searching to own a smaller size repair, select posts that need makeup strategies such the new indoor and you may exterior paint, fresh carpet and you may floors, instrument improvements, and you will first landscaping fix. Costly and you can inside programs include re also-roofing, replacing plumbing system and you can sewer lines, substitution Cooling and heating systems, and you may complete-measure area remodels.

- Choosing installment loans for federal employees Missouri a specialist for the Remodel

- Inspections: Past a basic home examination, which covers parts of the house such as for instance its plumbing and you will foundation, think authoritative inspections for insects, roof certifications, and you may technologies account. This will help identify amongst the property’s minor flaws and you may vital dilemmas, next informing your choice when the time comes to set up a keen bring.

- How do i create an offer into a property?

Resource Selection

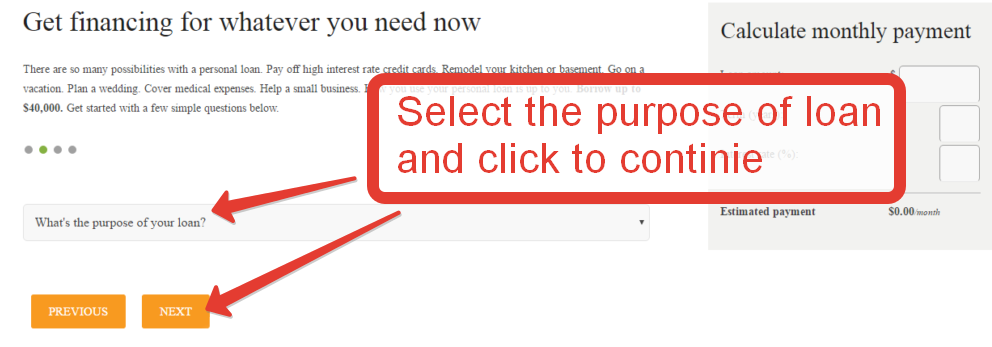

You will be thinking about different types of mortgages when purchasing a great fixer-higher, however, remember that restoration loans especially allow it to be people so you’re able to finance the house while the advancements on the assets together. Extra consultation services, monitors, and you will appraisals are required in the borrowed funds procedure, nonetheless assist guide the job and resulting house really worth.

- FHA 203(k): The fresh new Federal Property Administration’s (FHA) 203(k) loans are used for extremely methods undergoing fixing up a home. When compared to old-fashioned mortgages, they might take on straight down incomes and you will fico scores to have licensed individuals.

- Va repair mortgage: With this specific loan, the home upgrade costs are combined towards loan amount to own the house purchase. Designers working in any renovations have to be Virtual assistant-recognized and you will appraisers active in the appraisal process should be Virtual assistant-authoritative.

- HomeStyle Loan Federal national mortgage association: The latest HomeStyle Renovation Financing can be utilized from the buyers to find good fixer-top, or from the residents refinancing their homes to afford improvements. So it financing also enables deluxe tactics, such as for instance pools and you will landscaping.

- CHOICERenovation Loan Freddie Mac computer: That it renovation mortgage is protected by way of Freddie Mac, enabling systems one reinforce an effective home’s capacity to withstand disasters or resolve ruin for the reason that a last crisis.

If you find yourself wanting to find an effective fixer-top, connect with myself I will help you see the procedure in order to talk about what makes the very sense for your requirements.

I earn the new believe and you may loyalty of our own agents and you will members by doing home acutely well. At the forefront of all of our markets, i submit visitors-centered services inside a genuine, collaborative, and clear manner along with the unrivaled knowledge and you can assistance you to definitely arises from many years of expertise.