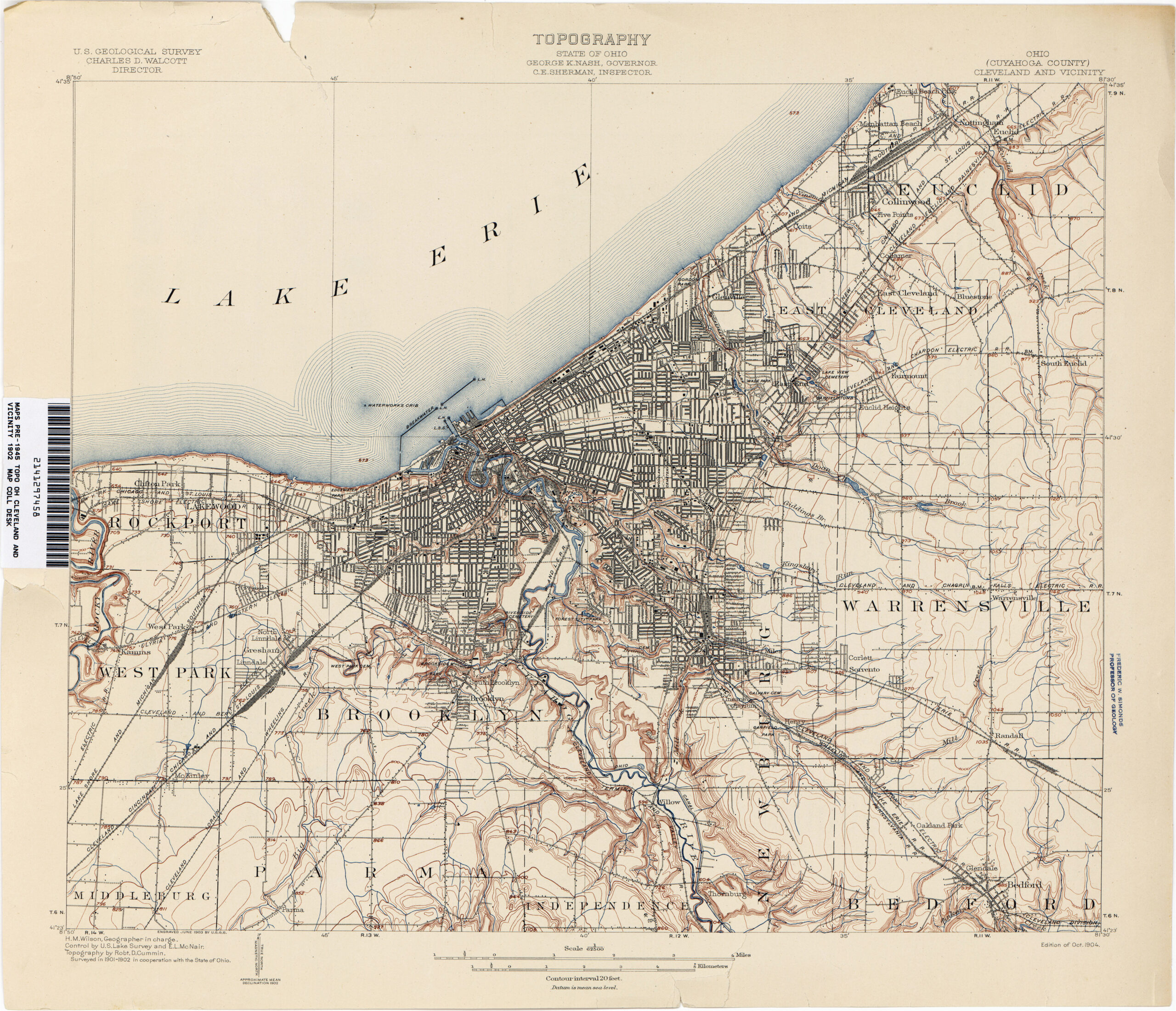

Display

To buy a house is amongst the biggest goals inside the anybody’s life-it’s one of the most expensive expenditures anyone can make. As a result, homebuyers will want to means one real estate get which have plenty of preparation. Even though it may be enjoyable so you can comb owing to domestic listings, listed below are some open households, and you may envision lifetime within the a property with a well-beautiful lawn, expansive yard, and you will modern kitchen area, it is necessary that possible people run getting their funding when you look at the order to begin with.

For many of us, the biggest obstacle it face during the to buy property gets home financing. Since the majority people don’t have the methods to buy a house outright, lenders to allow more people in order to become residents. Securing home financing are a critical step in our home-to purchase trip, but the majority of basic-go out home buyers may well not can get a home loan. The loan acceptance process can seem to be daunting, but with just the right planning, it will in fact become quite pain-free. Following such ten measures, homebuyers could possibly get a mortgage loan in place of running into any too many delays otherwise difficulty.

Before you start…

It isn’t strange for all those to wait up to they wish to make a deal to your a house to start considering investment, nevertheless can get currently become too late if so. Vendors normally want to know one to a buyer has actually financing positioned before they commit to a deal. That is particularly so for the aggressive real estate markets where providers will get located multiple also provides and certainly will manage to be most choosy about choosing a buyer. Taking an effective preapproval letter away from a lending company before you start the new house-bing search processes is frequently recommended so homebuyers can make an offer off the right position regarding fuel.

Possible homebuyers must prepare yourself on their own on the comprehensive monetary examination that the loan preapproval and underwriting procedure often concerns. Providing preapproved getting a home loan will require a credit query, at minimum, but lenders may consult spend stubs, financial comments, otherwise previous taxation statements to find a better sense of an applicant’s financial predicament and you can capability to do obligations prior to getting an effective preapproval page.

Ultimately, new methods intricate below on exactly how to score a mortgage loan is worried about the method whilst makes reference to to shop for a good house. People who are looking to re-finance the established home loan can always explore all of these methods once the a guide, in the event, given that guidance focusing on bank selection, loan application, and underwriting also are connected to mortgage refinancing.

Step 1: Work out how much domestic you can afford.

One action homebuyers should get whenever preparing to score a mortgage is mode a realistic house finances. One reason why it’s very important to rating preapproved before searching for a separate residence is one borrowers can see the loan amount it qualify for-by extension, how much cash house capable manage. That have this particular article at your fingertips facilitate home buyers slim its browse and put ideal expectations to have a bona-fide home purchase.

Before going through the preapproval techniques, consumers could possibly get a better sense of exactly how much they may be eligible for that with house affordability hand calculators to assess its to get fuel. Such on line tools can display what sort of funding can be done, but every house consumer will have to decide for by themselves how much they have been comfy shelling out for a new family.

There are lots of will set you back that go towards the to purchase a home, as well as right up-side expenditures and you may repeated expenditures. Normally, consumers should offer a downpayment towards a different domestic, which is a lot of currency to own toward hands. Home buyers will need to put forward serious currency whenever to make an offer into a payday loans Indiana property, buy property examination and you may assessment, and you may cover a variety of settlement costs.