Truist entirely now offers house guarantee lines of credit (HELOCs) and never antique domestic security loans. Truist HELOCs are available in fixed price, varying rates, and you can desire-simply money.

A HELOC try an unbarred line of credit which allows people so you’re able to borrow on their house’s equity. Costs, charges and fees terms and conditions will vary by the financial, however, good HELOC generally allows you usage of the credit line getting a decade, and provide your twenty years to repay extent you borrowed.

HELOCs is actually an adaptable option for sets from funding home improvements to help you paying higher focus loans (HELOCs generally have straight down interest rates than playing cards).

Has the benefit of repaired, changeable and desire-merely payment HELOCs

.png)

Truist provides the independency off about three different varieties of HELOC facts. As well as the the second repaired price choice loans Nondalton, the business comes with variable interest and interest just cost HELOCs. Varying speed HELOCs give you the chances of paying quicker for the tomorrow should your speed falls, and you can notice only costs allows you to make reduced payments throughout the fresh new mark months.

Merely even offers HELOCs

Truist’s domestic equity items are simply for lines of credit. The organization does not provide household guarantee fund. If you find yourself interested in that one, below are a few our range of a knowledgeable house guarantee funds.

$50 annual commission pertains to people of a few claims

Truist demands an effective $50 yearly fee for the following states: Alabama, Arkansas, Ca, Fl, Georgia, Indiana, Kentucky, Nj-new jersey and you can Ohio.

Investment characteristics cannot qualify

Truist HELOCs aren’t available for resource services, cellular otherwise manufactured house. As with extremely banks, the property utilized just like the guarantee should be an owner-occupied household, a single-family tool, an excellent condominium otherwise an initial and you may second residence.

Restricted access

Only at that creating, Truist HELOC is only designed for functions situated in any of the brand new 19 claims where the bank works, including Arizona D.C..

Truist Home Security Financing Offerings

Truist also provides a variety of financial factors having users and enterprises. But not, regarding household collateral finance, the actual only real device it’s got was lines of credit.

Household collateral line of credit (HELOC)

Truist HELOCs come with repaired or variable prices, and the normal 10-season mark months and 20-12 months cost several months that loan providers render. But not, you are able to choose to generate desire-just costs.

Fixed-rate cost

Using this bundle, your focus and you will mortgage terms and conditions have decided at the beginning of the bargain and won’t changes about life of your own financing. Might come across good sixty, 120, 180 otherwise 240-times package that’ll influence the fresh new monthly prominent payment. Create desire and you can appropriate charges, and you’ve got the fixed payment per month.

Variable-rates installment

Having Truist’s varying-price installment choice, your own repayment number tend to change because the interest levels rise otherwise fall. Your own minimum payment is dependant on your the balance and you can has both desire and you can a percentage of your own principal harmony. All the commission you make will help lower your dominating equilibrium, and you will expenses more than minimal expected tend to affect the amount of your own upcoming costs. Minimal payment with this particular choice is step 1.5% of your own overall a fantastic harmony of the loan amount.

Interest-just installment

Using this commission bundle, your minimal payment equals the eye accrued towards an excellent equilibrium for the earlier few days. Having Truist’s focus-just fees, their minimal payment per month doesn’t slow down the dominating balance, as well as the interest rate are changeable. This one will work for those who want to make smaller money at the start, but may commit to large money later.

Truist Domestic Equity Financing Pricing

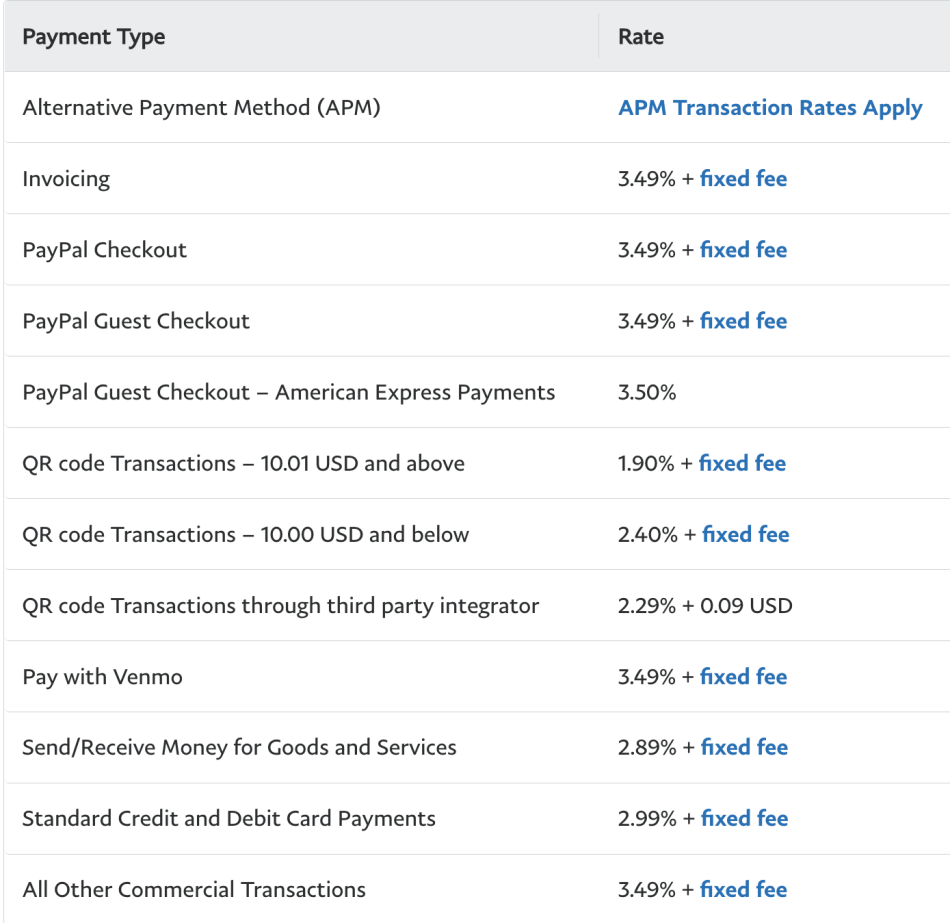

Apart from appeal, the costs regarding the good Truist HELOC are prepared-upwards costs, origination fees, yearly charges and you may settlement costs. As previously mentioned more than, you can find nine claims in which you would have to pay a $50 yearly fee. Truist fixed-speed HELOC may also be susceptible to a great $fifteen put-up percentage, with respect to the line of credit limitation and you can terminology.

Regarding settlement costs, Truist will pay settlement costs to possess credit lines doing $five hundred,000. Understand that which have settlement costs covered by Truist will get bring about highest rates. A different pricing to remember is actually prepayment penalties. Which have a great Truist credit line, you might have to shell out origination or closing costs if the membership try signed contained in this 3 years regarding beginning.

Truist Family Guarantee Mortgage Usage of

Truist features more than dos,five-hundred branches in the 17 states and Washington D.C.an effective. Along with the brick-and-mortar branches, Truist possess a powerful web site with several info and you may a mobile financial app.

Availability

- Arkansas

Contact info

Truist’s customer support can be acquired Friday through Saturday, off 8 are to 8 pm EST and you may Monday, 8 have always been so you can 5 pm. From the Truist assist cardio, you can also find twigs, advisers or apply to Truist toward social networking.

Consumer experience

Truist earns an one+ company rating regarding Better business bureau (BBB), and has come qualified since the 1986. Even when Truist provides acquired so it accreditation, we shall dive on particular issues one of users lower than. The brand new Bbb doesn’t reason for consumer analysis when deciding on brand new levels and you will dependability regarding a company.