Put aside and you can Federal Guard professionals play a crucial role within our country’s safety, and they also have the opportunity to accessibility homeownership professionals using Virtual assistant financing. Knowing the eligibility standards to possess Va financing as a person in the fresh Federal Guard or Set-aside is very important of these looking to purchase a property. Within this educational and creative website, we’re going to talk about just how Set-aside and you may Federal Protect members can acquire Va finance, the new lengthened eligibility conditions, credit and you may earnings standards, the importance of old-age issues, necessary records, and you will beneficial ADPI Specialist Tips to help you browse the brand new Virtual assistant financing process.

Ways to get a Va Loan once the a great Reservist otherwise National Protect Member

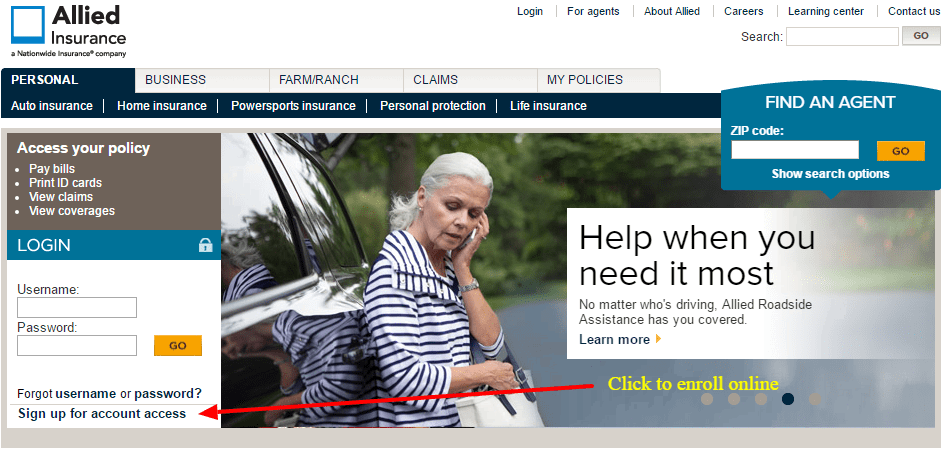

Because an effective Reservist or Federal Shield member, getting an effective Va loan needs satisfying particular qualifications requirements. To begin with the method, you will want to obtain the Certification out-of Eligibility (COE) in the You.S. Company of Experts Products. It file verifies the qualification into the financing system. After you have their COE, you might run an excellent Virtual assistant-acknowledged financial who can assist you from the software process and you may help you in securing a beneficial Virtual assistant mortgage.

Getting Your COE due to the fact a member of this new Supplies or Federal Guard

Reserves/ Federal Guard, immediately after half a dozen numerous years of provider or with a service-connected Virtual assistant impairment, can also rating accredited sometimes. Be prepared to display your own point layer together with your lender. Based their status and you can accessibility different options, in addition there are your Certificate out of Qualifications out of Age-masters, because the in the list above.

If you had a beneficial ninety-big date service that have 1 month regarding successive provider which have identity thirty-two USC area 316, 502, 503, 504, otherwise 505, you may be eligible for a great Virtual assistant mortgage! For the reference, this is passed at the beginning of 2021 within the an excellent Virtual assistant Rounded (26-21-08). This could be a casino game-changer for some your pros. Ask your financial and you may continue seeking advice and you may lenders who are super cutting-edge on the guidance toward Virtual assistant loan qualifications. Due to the fact a property buyer, might always be doing search to keep your household right up, just in case you become a trader, you’ll installed more try to make sure your funding was straightened out while some try purchasing you. Why don’t you begin their journey out-of preparing by the considering every of your experts starting today before you purchase?

People in the latest Federal Guard or Put aside who had been never triggered once release

On top, people in the world Protect or Set aside who had been never ever triggered and was discharged commonly eligible for the brand new Virtual assistant financing. A few of the wordy means of government entities may also get-off space to possess translation, and now have there are some other qualifying products that will make it users to be eligible for some great benefits of an effective Virtual assistant financing. A mortgage lender that is accredited and incredibly acquainted the fresh new changes in what’s needed into the regulators-recognized Virtual assistant loan is the perfect place a part want to begin whenever which have their personal circumstance examined. Good no on the surface may not be the very last respond to. Brand new Va do have a look at for every single circumstances delivered to them and you may tend to have a look at to see if discover people being qualified items one to allows an associate to use brand new Va work for, however it is not necessarily simply a certainly or no respond to. Speak with a lender and discover what they makes it possible to which have.

Can i Get a Va Loan due to the fact a person in this new National Shield or Reserve?

Yes, members of the brand new Federal Guard and you may Reserve meet the criteria to have Va funds, considering it meet certain requirements. Qualification is decided predicated on issues like duration of provider, sort of services, and profile out of provider. Basically, Federal Protect and Put aside users getting qualified just after doing six ages out-of services, unless triggered to have government services, in which case eligibility could be americash loans Bethlehem Village offered at the an early on time.