We install a selection of the fresh affordability metrics within our very own the newest, annual HPI Affordability Report. Such indications thought affordability all over a examine the link variety of other characteristics.

For the past few years, money progress provides broadly remaining rate which have family rates development, meaning that the ratio out-of domestic rates to mediocre income (HPER) enjoys stayed seemingly secure, albeit from the an advanced. At the end of 2020, great britain First-time Consumer (FTB) family speed so you can income ratio endured at 5.2, near to 2007’s listing high of 5.cuatro, and you can better above the long run mediocre off step 3.7.

I have as well as viewed a significant expanding on the gap anywhere between at least reasonable and more than affordable countries. London area could have been minimum of affordable area for almost all of previous 40 years – our home price so you can income proportion regarding the money hit a great checklist chock-full of 2016 of ten.dos and stayed elevated from the 9.2 at the conclusion of 2020.

Scotland currently comes with the lower domestic rate to help you money proportion from the 3.dos, closely followed by this new Northern from the 3.step 3. Looking over the long run, Northern The united kingdomt and Scotland has actually historically viewed all the way down home rate in order to earnings rates than simply Southern The united kingdomt, Wales and North Ireland.

Among the effects out of highest household pricing in line with earnings, is the fact it can make increasing a deposit a significant difficulty to have prospective first time people. In reality, at the moment, an excellent 20% put is equal to 104% of one’s pre-taxation money of a typical full-time personnel, up off 87% 10 years back, even though there is actually tall regional version.

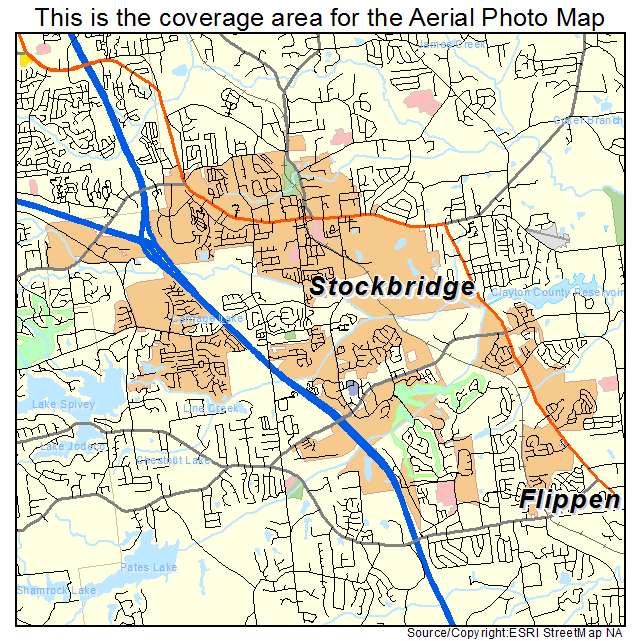

This will be portrayed throughout the graph (come across affixed PDF), which ultimately shows the typical day it would get individuals making this new regular wage into the per part to keep a good 20% put to your a consistent FTB property, whenever they kepted fifteen% of their capture-home spend every month.

Recently a life threatening ratio of first time customers possess become drawing to the help from friends and family or an inheritance to assist increase in initial deposit, given that depicted regarding chart (come across attached PDF).

During the , doing forty% out of first-time customers got some assistance elevating a deposit, in a choice of the form of a present or mortgage away from members of the family otherwise a pal or because of heredity.

Thankfully you to for people who can improve in initial deposit, the price of the average month-to-month homeloan payment in accordance with simply take-house spend could have been trending down in recent years.

During these groups, regular home loan repayments carry out depict more 40% off mediocre simply take-house pay

Given that chart (come across connected PDF) reveals, first time client home loan repayments (according to a keen 80% loan-to-well worth mortgage, within prevailing home loan costs) are presently just below the future mediocre, at twenty eight% from need-home (net) spend.

That is right up from around a-quarter in the mid-1990s

Value improved somewhat between 2007 and you will 2009, mostly as a result of the belong family prices about wake of your own overall economy, and you may remained reasonable, due to the decrease in borrowing from the bank costs to-time lows.

The price of servicing the typical mortgage because a portion from take-household spend is close to if not slightly below the fresh a lot of time focus on mediocre for the majority places, since the shown in the graph (look for connected PDF).

However, over the past a decade, a growing proportion from first-time buyers was basically choosing in order to sign up for enough time-title mortgages to advance all the way down the month-to-month costs (in the event which advances the complete number reduced along side life of the borrowed funds).

For the 2020, as much as 70% of first-time buyers got aside a mortgage that have a first term of over 25 years, up regarding forty five% this present year. Increasing the mortgage label of twenty five to thirty five years (the most commonly known) escalates the full number of interest repaid with the a typical mortgage because of the 40%.

We’ve together with examined how value varies for all those in numerous procedures looking to purchase their first possessions. Possibly needless to say, home loan repayments according to take-home pay was lower for those when you look at the managerial and you may elite jobs, in which mediocre income is large.

Note that talking about standard tips, which use the common income into the for every single work-related classification, plus the Uk regular very first time buyer assets rates. In practice, those who work in large paid down job should get higher priced properties.

Affordability is actually most difficult for those doing work in parts classified because basic occupations’, which include work such as construction and you may creation labourers, cleansers and you will couriers, and people for the care and attention, leisure or any other private services efforts.

The distinctions in value reflect brand new divergence within the money by the work-related group. Like, people in elite job generally take home to 75% much more a year compared to those in transformation and you may customer support.