It may be frustrating and disheartening having your own financial application denied, particularly if you have been aspiring to pick a house.

If your home loan app gets refuted, the lender possess failed to leave you that loan. This will be for different causes, including less than perfect credit record or perhaps not that have enough money. While denied, its required to understand why to evolve your odds of qualifying the next time.

As to why Did Your residence Application for the loan Declined

- You have a less than perfect credit records. The preferred need is bad credit records. If you have the lowest credit rating, loan providers may view you due to the fact a premier-exposure borrower and get unwilling to give you a loan.

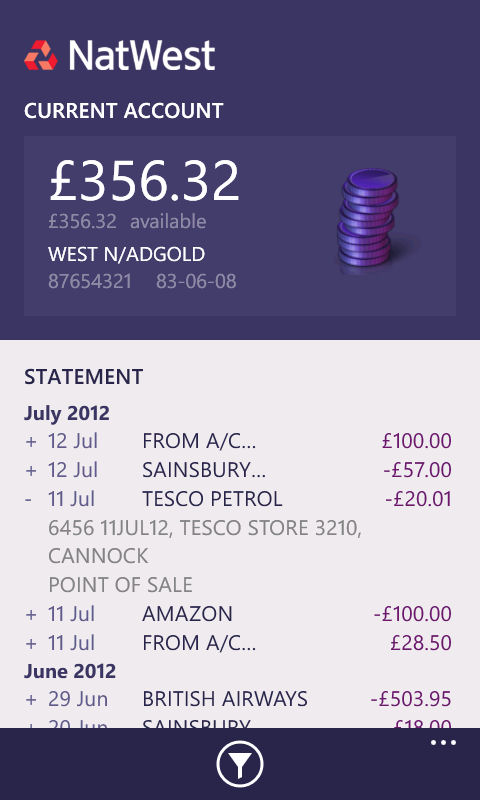

- You don’t need to proof you could repay it. Loan providers might look at the a career record, bank comments, and you can tax statements to obtain a thorough picture of your financial problem. If any of them items commonly up to par, this may produce a denial of one’s application for the loan.

- Your a career history is volatile. Loan providers like to see that you have a stable source of income and can make your mortgage costs promptly monthly. When you yourself have volatile a job or a source of income, enough income to cover financing costs, then lender is unwilling to give you a loan.

- You do not have adequate deals. Lenders typically want individuals to put down about 20% of one’s house’s cost as the a down-payment, so if you lack adequate saved up, they may refuse your loan software.

Imagine if You Currently Bought a home

If you have currently bought a property, you’ll be able to inquire what you should do whether your home loan software is refuted. There are many available options to you personally:

- You can attempt to help you attract the option into financial. This may involve delivering even more documentation otherwise information about your financial disease.

- You can attempt to help you re-apply on mortgage having a separate financial. Then it difficult whether your credit rating has not enhanced as you very first applied for the borrowed funds.

- You can attempt to help you discuss for the house supplier observe if they are willing to assist you on the financial support selection. That one might not be available when you’re already during the escrow or keeps finalized towards the possessions.

Which are the Actions to switch The next Application for the loan

There are some steps that you could attempt raise your chances of delivering recognized to own home financing:

- Change your credit score. Lenders consider this to be the very first thing in relation to a loan application. When you have a minimal credit score, you will need to increase it if you are paying regarding debts and you may while making all of the payments punctually.

- Save to have more substantial down payment. Loan providers generally wanted individuals to get down at the least 20% of one’s home’s price while the a down payment, so if you can increase the coupons, it can replace your odds of taking accepted for a financial loan.

Completion

It’s important to just remember that , home financing app rejection was not payday loans without phone calls the end of the country. There are lots of other choices open to the individuals happy to speak about them. Following the this advice in accordance with a little work will ultimately see a mortgage that meets your position.

If you are looking having a mortgage broker around australia , look no further than Shore Financial. You will find a group of knowledgeable and licensed home loans whom concentrate on finding the optimum home loan for you. We manage individuals lenders to obtain the finest offer you’ll. Let’s help you find ideal mortgage for your demands. Guide a scheduled appointment with a expert mortgage brokers today!