The flexibility Act will bring a safe harbor from decreases within the mortgage forgiveness according to reductions completely-go out similar team for borrower with perhaps not managed to go back to the same amount of team activity the company is working on prior to , due to conformity having requirements otherwise recommendations given ranging from by Secretary away from Health and Person Characteristics, the newest Movie director of Facilities getting State Manage and you will Avoidance, or the Work-related Health and safety Government, connected with staff member or consumer cover requirements associated with COVID19; and also will bring a safe harbor to add defenses for individuals that are both unable to rehire individuals who were group regarding the fresh new borrower for the , and unable to get furthermore certified teams to own unfilled positions by .

This is why you might still be eligible for forgiveness, even though you needed to decrease your staff on account of regulators directives.

What In the event that you Would Today?

Do not make any PPP Financing repayments up until we have informed your you to payments is actually due. We’ll get in touch with your away from people necessary modifications into the PPP Loan data

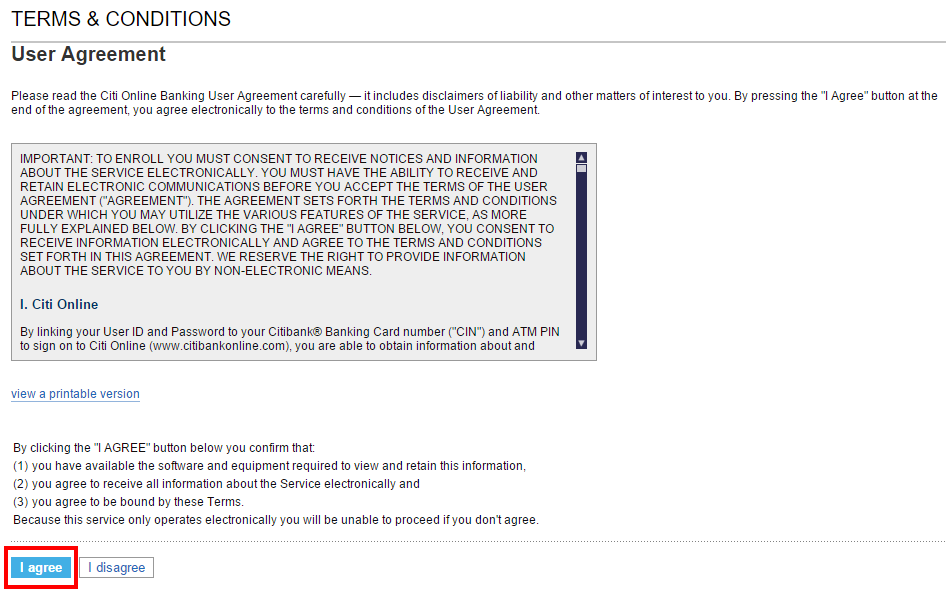

PPP Mortgage Forgiveness Site

With the objective out-of easing the burden on the entrepreneurs and you will promoting the newest the amount of their loan forgiveness, i have introduced a PPP Loan Forgiveness Portal having Meridian Financial PPP consumers. So it entertaining and you can affiliate-amicable this new program will make sure simple and easy successful control from PPP financing forgiveness demands for the SBA, enabling users to help you:

- Securely publish and index data files

- Use the forgiveness calculator to estimate your forgiveness qualification

- Electronically sign the past mortgage forgiveness application

- Streamline the process for finding back again to business

- Will set you back linked to expenses from a borrower so you’re able to a supplier of goods for important offers that are made pursuant in order to an effective deal, purchase, or get order???

Debtor acquired the PPP mortgage proceeds into the Friday, April 20, and also the first day of the basic pay months after its PPP loan disbursement try Weekend, April twenty six.

Fundamentally, full FTE amount ought to be the exact same or more than pre-pandemic account in order to be eligible for complete mortgage forgiveness; yet not, your during the deciding if or not your meet up with the tolerance to possess full forgiveness. At exactly the same time, this new PPP Self-reliance Work stretches that time in which employers could possibly get rehire or dump a decrease in work, income otherwise cashadvanceamerica.net/payday-loans-de earnings who or even slow down the forgivable amount of an effective PPP mortgage in order to , or perhaps the end of one’s covered months.

How much of one’s mortgage will be forgiven easily meet the requirements toward 3508EZ App just like the We have not less wages or salaries?

The fresh rule helps it be clear one to when you’re financing more than $2 mil is actually susceptible to opinion to the necessity of the loan request, any financing can be susceptible to an assessment to own conformity that have eligibility, amount borrowed, and forgiveness. Especially, underneath the the new 2021 IFR toward mortgage numbers for notice-employed somebody, Schedule C filers using revenues so you’re able to estimate loan numbers having more than $150,000 inside the gross income doesn’t immediately become deemed for generated this new statutorily requisite degree about the need of the borrowed funds demand inside good-faith. This presents an increased likelihood of new financing becoming at the mercy of the brand new SBA’s financing remark techniques because of the SBA to guarantee the legitimacy of your borrower’s criteria.

cuatro. Longer FORGIVENESS Secure HARBOR

- S-business holder-employees are capped because of the number of their 2019 or 2020 employee bucks compensation and you will employer later years benefits made for them, but boss medical health insurance benefits made for them can not be on their own extra while the those individuals repayments are actually included in their worker bucks settlement.