The difference between construction fund and you will restoration loans is based on the fresh kind of venture. Design money are used for the services with decisive project arrangements. Individuals who fool around with construction money might generally speaking transition with the a beneficial normal mortgage after the building project. On the other hand, renovation funds to have buyers are accustomed to pick fixer-uppers or even to remodel current features. These types of loans can be used for makeup and you may structural repairs, particularly insulating a property otherwise updating a kitchen.

[ Happy to make the step two on the a home education? Know how to start-off during the a property using from the gonna all of our Online a residential property class. ]Do you Get a homes Mortgage To own An investment property?

Yes. You can get a housing mortgage having an investment property if the your project arrangements and you may profit meet appointed bank conditions. Unlike particular home loans, there is absolutely no techniques proclaiming that a property loan must be applied to a primary residence. Structure financing should be a beneficial choice for financing a financial investment assets for some reasons. Especially, home investors likely have sense handling designers and you may managing restoration methods currently. For this reason, they are suitable so you’re able to oversee the construction regarding a brand new property.

There are also repair loans having a residential property acquired because of the adopting the a comparable recognition techniques. Traders shopping for a restoration framework loan find your loan is distributed in line with the shortly after repair worth of this new property at issue. This is how your buyer tool system is available in convenient. Rely on an effective leasing assets calculator and you will contractor when determining regardless if a remodelling financing ‘s the proper move to possess a certain endeavor.

How to Qualify for A property Financing?

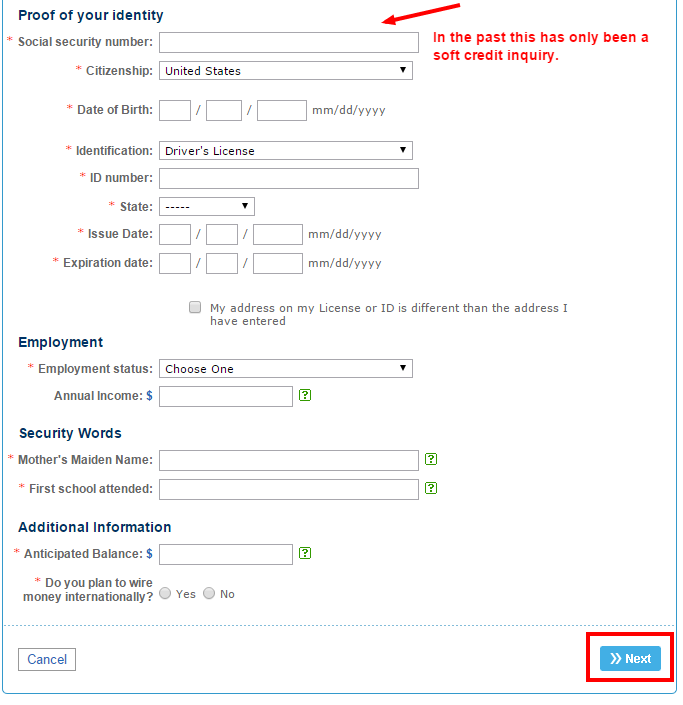

So you can be eligible for a property loan, individuals need to see numerous financial requirements also that have their enterprise agreements recognized. To start, loan providers tend to typically feedback the debt-to-money proportion and you will borrowing from the bank. Once the specific criteria are different considering your own bank, of several require a credit score away from 650 or more. Consumers must have a down-payment when installing a beneficial construction loan, that should usually getting anywhere between 20 and you will 30 percent. Make sure you research rates when shopping for a loan provider; there are many solutions having acquiring a casing financing, and each will come with assorted criteria.

To discover the last recognition getting a property otherwise restoration financing, you ought to also fill out this new project’s structure preparations. Lenders may wish to come across detailed arrangements for the assets and you will a small grouping of certified builders attached to the opportunity. It is very important know that while you perform you desire completed plans to your latest financing recognition, you can get preapproved to own a housing financing prior to purchasing a beneficial possessions.

Best Particular Loan For Financing Characteristics

About three build mortgage sizes are best for investment attributes: enhance and you may flip fund, pick and you can treatment funds, and you may construction/pick and construct financing. Normally, capital construction money is compensation money. In such a case, the lender covers for every single stage from design because is done and you may finalized of of the inspectors. Let us read the finest type of fund for developing funding functions:

Improve & Flip Funds: This type of funds are great for the fresh opportunist who has got knowledge of to get, repairing, and you can reselling properties within a short period. So as to most traditional loan providers and you may banking institutions will receive nothing wrong dominant site financing such strategies as long as you adhere to good sense hard currency underwriting recommendations. Just what will number many for it financing will be your sense for the efficiently turning functions for-profit plus the stability of opportunity concerned.